If you’ve ever wondered what keeps America’s paychecks running smoothly every week, the answer is US payroll specialists. They’re the unsung heroes ensuring every dollar, deduction, and tax is accounted for. In an economy where compliance errors can cost companies thousands, payroll professionals are indispensable.

The best part is you don’t have to live in America to work on the US payroll. Thanks to the rise of remote jobs and global HR outsourcing, skilled payroll professionals across India and beyond are managing payrolls for companies in the United States.

In this guide, you’ll learn how to become a US Payroll Specialist, the essential skills and tools to master, the certifications that can fast-track your career, and why now is the perfect time to get started.

What Does the US Payroll Specialist Do?

A US Payroll Specialist manages employee compensation for companies operating within the US. They ensure wages are calculated correctly, taxes are withheld properly, and benefits comply with federal and state laws.

According to the U.S. Bureau of Labor Statistics, payroll specialists fall under the broader category of Payroll and Timekeeping Clerks, with a steady employment outlook and thousands of openings every year.

Here’s what a typical day looks like:

| Task | Core Skill Required |

| Processing payroll for employees | Accuracy and Excel proficiency |

| Calculating federal and state taxes | Knowledge of U.S. tax codes |

| Handling benefits and deductions | Understanding of FLSA & IRS rules |

| Maintaining employee records | HRIS or payroll system skills |

| Generating reports for management | Analytical and reporting abilities |

Payroll specialists don’t just process payments, they also protect companies from compliance risks and ensure employees are paid accurately and on time.

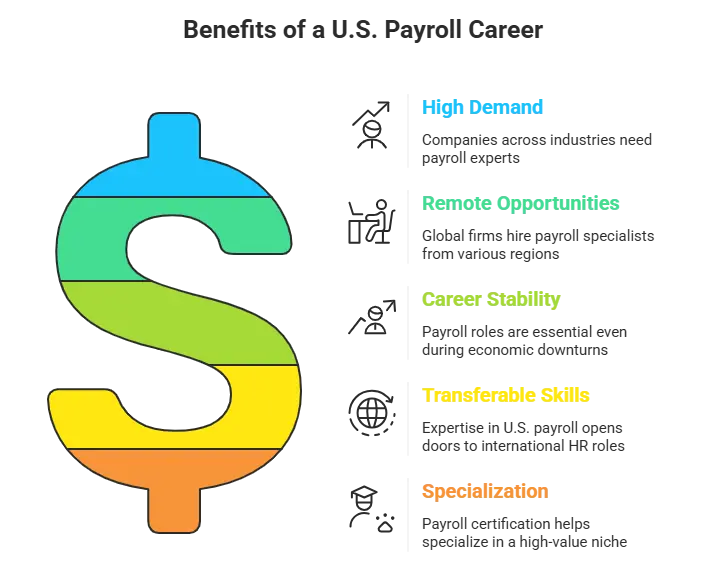

Why Choose a Career in US Payroll Management?

The demand for payroll professionals has skyrocketed, particularly with businesses outsourcing HR and payroll functions globally.

As per Indeed, the average US payroll specialist earns around $60,000–$70,000 per year, with experienced professionals making upwards of $85,000 in larger firms.

Here’s why this field is worth considering:

- High demand: Companies in every industry require payroll experts.

- Remote opportunities: Many global firms now hire payroll specialists from India and Asia.

- Career stability: Payroll roles are essential even during economic downturns.

- Transferable skills: Your expertise in U.S. payroll can open doors to international HR roles.

- Specialization: If you’re already in HR, accounting, or SAP, payroll certification can help you specialize in a high-value niche and command better pay.

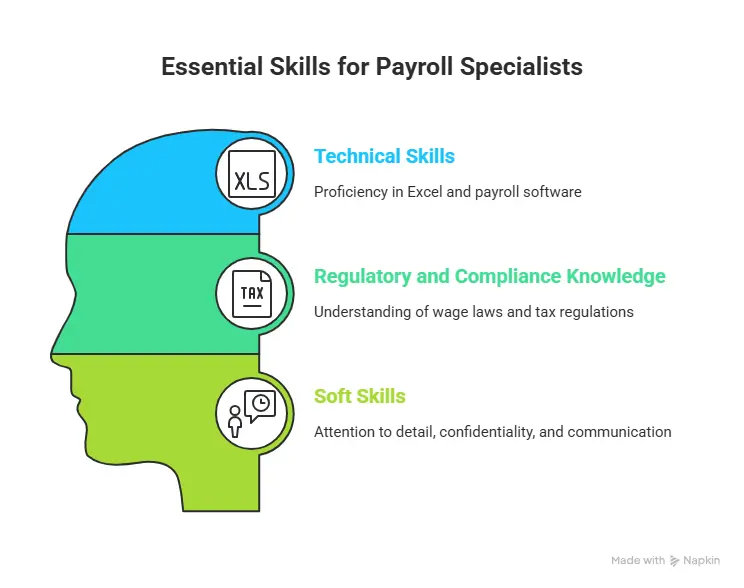

How to Become a US Payroll Specialist: Key Skills You Need

To succeed in payroll, you need a mix of technical, legal, and interpersonal skills.

1. Technical Skills

- Advanced Excel for calculations, pivot tables, and data management.

- Payroll software proficiency in tools such as ADP, Paychex Flex, QuickBooks Payroll, and SAP Payroll.

- Data accuracy, because even minor errors can have major financial consequences.

2. Regulatory and Compliance Knowledge

Understanding US wage laws, taxation, and compliance is critical. You’ll deal with:

- FLSA (Fair Labor Standards Act) for overtime and wage standards.

- FICA and FUTA taxes for Social Security, Medicare and unemployment.

- IRS guidelines — see IRS Employment Taxes.

3. Soft Skills

Payroll isn’t just about numbers. You’ll need:

- Attention to detail to ensure even the smallest data, that can result in higher productivity is not overlooked.

- Confidentiality to recognise and safeguard certain sensitive employee and company information.

- Communication for explaining pay slips or deductions clearly

- Time management to handle strict deadlines.

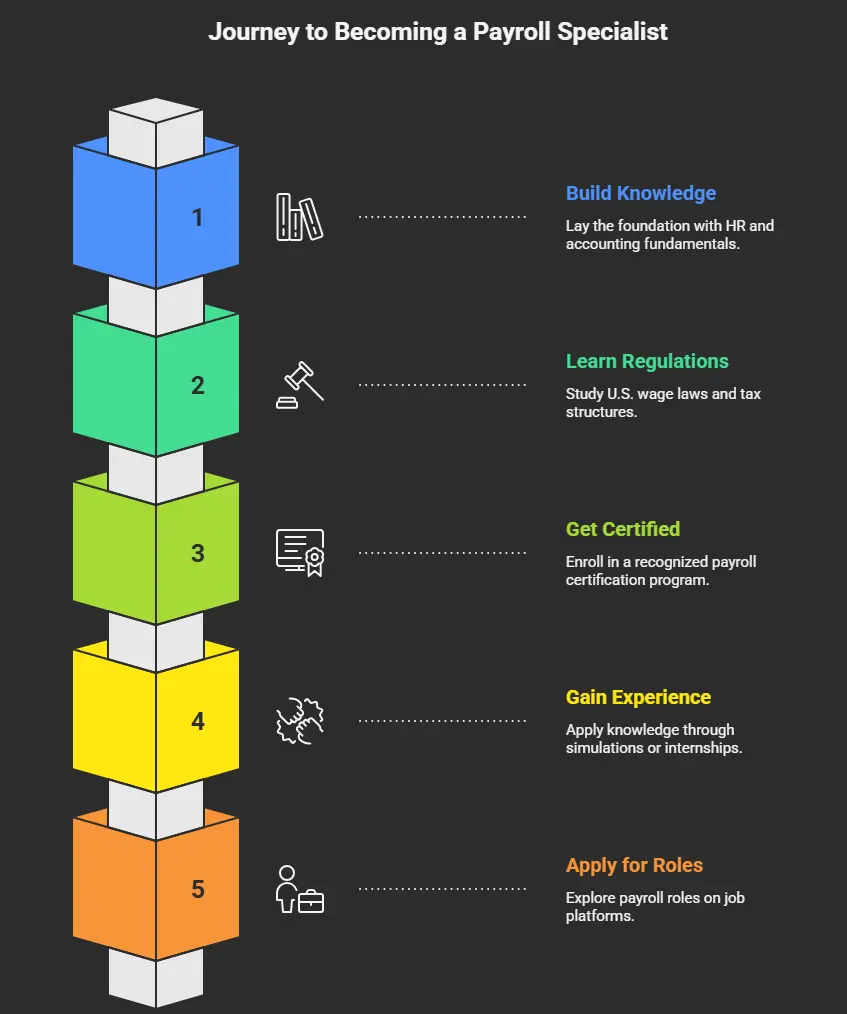

Step-by-Step: How to Become a US Payroll Specialist

Becoming a US payroll specialist isn’t complicated, but it requires structured learning and consistent practice. Here’s your roadmap:

Step 1: Build Foundational Knowledge

Start with an understanding of HR or accounting fundamentals. Knowing how compensation structures, benefits, and taxes work will give you a strong base.

Step 2: Learn US Payroll Regulations

Study U.S. wage laws, tax structures, and compliance requirements. The U.S. Department of Labor and IRS websites are great starting points for free, accurate resources.

Step 3: Get Certified

Enroll in a recognized US payroll certification program to gather necessary expertise from trained professionals.

A good course covers:

- Payroll processing steps

- U.S. taxation

- Wage compliance

- Tools like ADP, Paychex, and SAP

Certifications like SkillDeck’s US Payroll Certification Course or PayrollORG’s certified payroll professional, boost your credibility and employability.

Step 4: Gain Hands-On Experience

Apply what you learn through practical simulations or internships. Many payroll systems like Paychex Flex and QuickBooks Payroll offer trial versions or demo modes.

Step 5: Apply for Payroll Roles

Once certified, explore roles such as Payroll Assistant, U.S. Payroll Executive, or Payroll Analyst. Remote payroll jobs are available on LinkedIn, Indeed, and Glassdoor.

My Personal Experience: How Certification Transformed My Career

I began my career in HR but soon realized how vital payroll accuracy was. After completing a US payroll certification course, I gained hands-on experience with tools such as Paychex Flex and learned the essentials of US tax compliance. Within a few months, I transitioned into a US Payroll Specialist role, and it completely transformed my career path.

That experience taught me that payroll isn’t just about processing numbers, it’s about understanding the financial heartbeat of a company. Every payslip represents trust, compliance, and precision.

For anyone looking to specialize in HR or finance, payroll offers a unique blend of technical depth and career stability.

Top US Payroll Certifications to Consider

Several globally recognized certifications can help you establish expertise in U.S. payroll.

| Certification | Provider | Duration | Cost (Approx.) | Ideal For |

| US Payroll Certification | SkillDeck | 4–6 weeks | ₹20,000–₹25,000 | HR, Accounting, SAP Professionals |

| Fundamental Payroll Certification (FPC) | American Payroll Association | 3–6 months | $320–$395 | Entry-level payroll aspirants |

| US Payroll Fundamentals | Coursera & Intuit QuickBooks | 4 weeks | Free–$49/month | Beginners & Students |

If you’re in India or Asia, the SkillDeck certification stands out for offering region-specific guidance and live mentorship on US tax compliance — a rare feature compared to other self-paced online courses.

Career Opportunities and Salary Outlook

The U.S. payroll field offers stable and rewarding careers. Depending on your experience, location, and specialization, roles vary from Payroll Administrator to Payroll Manager.

| Job Title | Average Annual Salary (USD) | Experience Level |

| Payroll Assistant | $45,000 | Entry-level |

| Payroll Specialist | $65,000 | Mid-level |

| Payroll Analyst | $70,000 | Mid-level |

| Payroll Manager | $85,000+ | Senior |

| Global Payroll Lead | $100,000+ | Advanced/Managerial |

Sources: Glassdoor, Payscale, Indeed.

The best part? Many multinational companies are now outsourcing payroll functions to certified professionals in India, making this a lucrative remote career path.

Tools and Technologies in US Payroll

Familiarity with top payroll software enhances employability. Here are the most widely used tools:

| Tool | Primary Use | Key Advantage |

| ADP Workforce Now | Payroll, HR, compliance | Comprehensive enterprise suite |

| Paychex Flex | Payroll management, benefits | User-friendly for small businesses |

| QuickBooks Payroll | Payroll + accounting integration | Ideal for startups |

| Gusto | Cloud-based payroll | Great for remote teams |

| SAP Payroll | Enterprise payroll automation | Scalable for large organizations |

Learning to navigate these systems sets you apart in job interviews and helps you deliver faster, error-free results.

Frequently Asked Questions (FAQs)

1. Do I need a degree to become a US Payroll Specialist?

Not necessarily. While a degree in HR or accounting helps, certifications like SkillDeck’s or APA’s FPC can establish your credentials effectively.

2. Can Indian professionals work as US Payroll Specialists?

Yes! Many BPOs and HR outsourcing firms hire India-based payroll specialists trained in US compliance.

3. How long does it take to learn US payroll?

Typically, 4–8 weeks, depending on your learning pace and whether you pursue a structured US Payroll Course.

4. What are the biggest challenges in US payroll?

Understanding multi-state taxation, compliance updates, and accurate benefit deductions.

5. Which certification is best for beginners?

SkillDeck’s US Payroll Certification Course offers the perfect blend of hands-on training, tools, and compliance modules for new learners.

To Sum Up

The world of payroll might seem technical, but it’s incredibly rewarding once you understand its impact. From ensuring compliance to empowering employees through accurate pay, US payroll specialists play a vital role in global business operations.

If you’re looking to pivot into a stable, high-demand profession with international relevance, payroll is your gateway. Whether you come from an HR, accounting, or tech background, all you need is the right training and determination.

Ready to Take the Next Step?

Kickstart your global payroll career with SkillDeck’s US Payroll Certification Course which is designed for HR and finance professionals who want to master US payroll compliance, tools, and processes.

Gain practical experience with real payroll tools, learn from industry experts, and earn a certification that sets you apart in the global job market.

Enroll today and become a certified US Payroll Specialist.