Payroll deductions can feel like a mystery when you first look at your paycheck. Between your gross pay and what actually lands in your bank account, several deductions, some required, others optional, determine your final take-home pay.

These deductions aren’t arbitrary. They keep employees compliant with federal and state tax laws and ensure contributions to key programs like Social Security, Medicare, and health benefits. For employers, knowing exactly how each deduction works prevents payroll errors and potential penalties. For employees, understanding them helps with better budgeting and long-term financial planning.

Let’s explore both mandatory and voluntary payroll deductions in detail, using 2025 rates, contribution limits, and real-world examples.

What Are Payroll Deductions?

Payroll deductions are amounts employers withhold from employees’ gross pay to meet tax obligations or fund benefit programs. They fall into two broad categories:

| Category | Description | Examples |

| Mandatory Deductions | Legally required by federal, state, or local laws. | Federal income tax, Social Security, Medicare, state income tax, wage garnishments |

| Voluntary Deductions | Chosen by the employee to access benefits or savings plans. | 401(k), HSA, FSA, health insurance, union dues, charitable donations |

Mandatory deductions ensure compliance with tax laws. Voluntary deductions empower employees to personalize their benefits, sometimes with significant tax advantages.

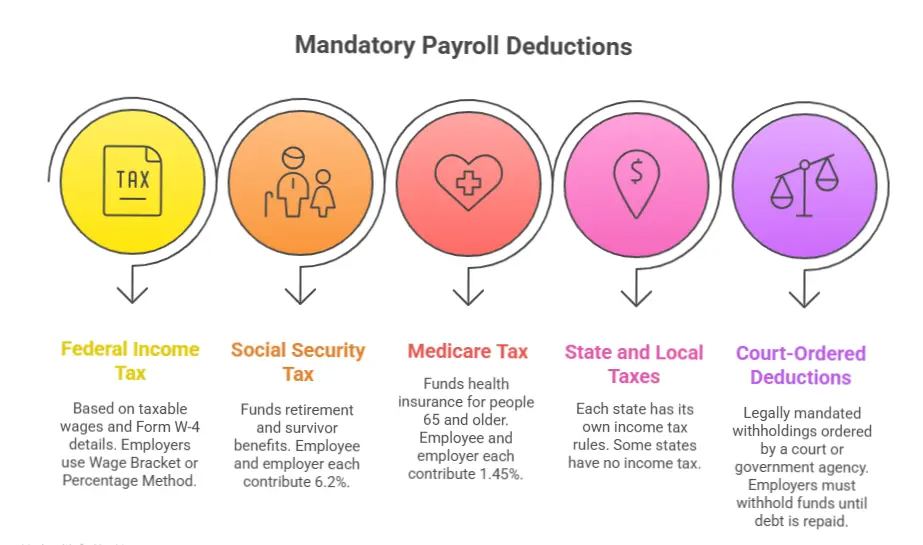

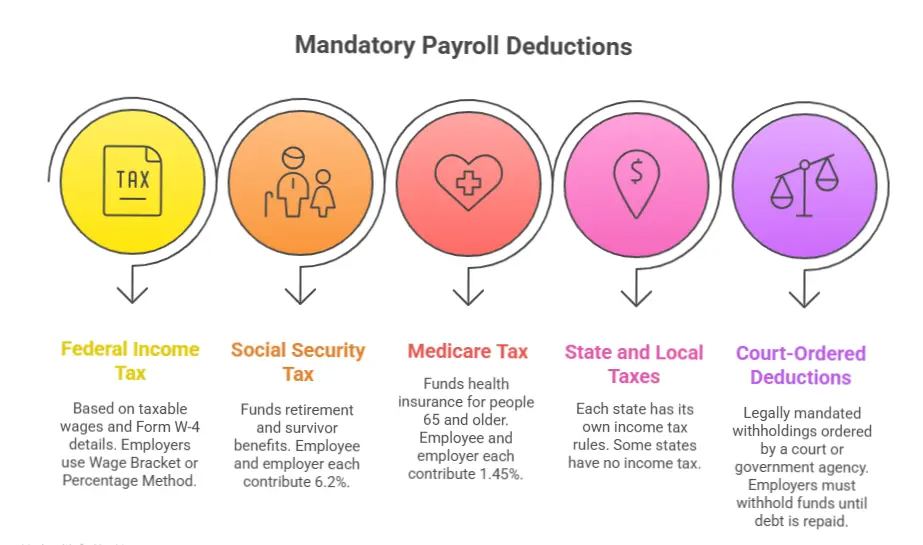

A. Mandatory Payroll Deductions

1. Federal Income Tax Withholding

The federal income tax is the most common deduction. It’s based on each employee’s taxable wages and the details provided on their Form W-4.

Employers calculate withholding using the IRS’s Wage Bracket Method or Percentage Method. Federal income tax rates are progressive, ranging from 10 % to 37 % for 2025, depending on income and filing status.

Example:

If an employee earns $2,000 biweekly and claims “Single, 1 dependent,” their federal withholding might be around $240 per paycheck, per the 2025 IRS tables.

2. Social Security Tax (OASDI)

The Social Security Tax, formally called the Old Age, Survivors, and Disability Insurance (OASDI) program, funds retirement and survivor benefits.

- Employee Rate: 6.2 %

- Employer Match: 6.2 %

- Total: 12.4 % combined

- 2025 Wage Base Limit: $176,100

Once annual earnings exceed the wage base limit, no further Social Security tax is withheld.

Example:

A worker earning $90,000 in 2025 pays $90,000 × 6.2 % = $5,580, with the employer contributing another $5,580.

3. Medicare Tax

The Medicare Tax funds health insurance for people 65 and older.

- Employee Rate: 1.45 % on all wages

- Employer Match: 1.45 %

- Additional Medicare Tax: 0.9 % on wages over

- $200,000 (single) or

- $250,000 (married filing jointly)

- $200,000 (single) or

Example:

An employee earning $250,000 owes:

- Standard 1.45 % = $3,625

- Additional 0.9 % (on $50,000) = $450

Total: $4,075

4. State and Local Income Taxes

Each state has its own income tax rules. Seven states, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, have no income tax.

States like California (13.3 %), Hawaii (11 %), and New York (10.9 %) have the highest top marginal rates in 2025.

Employers must register with the relevant state tax authority and remit withholdings correctly. For reference, see State Income Tax by State (Tax Foundation).

5. Court-Ordered Deductions (Wage Garnishments)

Wage garnishments are legally mandated withholdings ordered by a court or government agency. Employers are required to withhold these funds until the debt is repaid.

Common types include:

- Child Support: 50–60 % of disposable income

- Student Loans: Up to 15 % of disposable income (U.S. Dept. of Education).

- Tax Levies: Varies (typically 25–50 %) (IRS Topic 751).

Employers who ignore garnishment orders may be held liable for the unpaid amount.

B. Voluntary Payroll Deductions

Voluntary deductions enhance employee benefits and often provide tax advantages. They can be pre-tax (reducing taxable income) or post-tax (paid after taxes).

| Type | Timing | Tax Effect | Examples |

| Pre-Tax | Before taxes are calculated | Reduces taxable income | 401(k), HSA, FSA, health insurance |

| Post-Tax | After taxes | Doesn’t reduce current taxable income | Roth 401(k), union dues, charity |

1. Traditional 401(k) Retirement Plan

A Traditional 401(k) allows employees to save for retirement pre-tax, deferring income tax until withdrawal.

- 2025 Limit: $23,500

- Catch-Up (50+): $7,500

- Employer Match: Often 50 % of up to 6 % of salary

Example: Contributing 6 % of a $70,000 salary ($4,200) could save $1,000–$1,500 in taxes while growing retirement savings.

2. Roth 401(k)

A Roth 401(k) is funded with post-tax dollars. Withdrawals in retirement are tax-free if the account is held for 5 years and you’re 59½ or older.

- 2025 Limit: $23,500 (+ $7,500 catch-up)

- Ideal for those expecting higher future tax rates.

3. Health Savings Account (HSA)

An HSA is available to employees enrolled in a High-Deductible Health Plan (HDHP). It offers a triple tax advantage:

- Pre-tax contributions

- Tax-free growth

- Tax-free withdrawals for medical expenses

- 2025 Limits: $4,300 (individual), $8,550 (family)

- Catch-Up (55+): $1,000

- Unused funds roll over each year.

4. Flexible Spending Account (FSA)

An FSA helps employees pay qualified healthcare costs with pre-tax dollars.

- 2025 Limit: $3,300

- Carryover: Up to $640 (2025)

- Rule: “Use it or lose it.”

It covers expenses such as copays, prescriptions, and dental or vision care.

5. Dependent Care FSA

This plan lets employees set aside pre-tax income for childcare or eldercare required to work.

- 2025 Limit: $5,000 (joint) / $2,500 (separate)

- Eligible Expenses: Daycare, preschool, after-school care, adult daycare

See ADP’s Dependent Care Benefit Guide for eligibility details.

6. Health Insurance Premiums

Premiums for employer-sponsored medical, dental, and vision coverage are often deducted pre-tax under a Section 125 Cafeteria Plan.

Example: A $200 monthly premium can save around $784 per year in taxes, depending on the income bracket.

7. Commuter Benefits

Employees can use pre-tax dollars for transit passes or parking under IRS Section 132(f).

- 2025 Limit: $325 per month for transit and parking (each).

- Annual Tax-Free Maximum: $7,800

- Eligible expenses include bus passes, subway cards, vanpools, and qualified parking.

8. Group-Term Life Insurance

Employer-provided Group Term Life Insurance up to $50,000 is excluded from taxable income. Coverage above that creates “imputed income,” which is taxed to the employee.

Example: If coverage equals $150,000, only $100,000 is taxable.

9. Union Dues & Charitable Contributions

Union Dues: Typically post-tax, these funds are used for union operations and negotiations.

Charitable Contributions: Some employers offer payroll donation programs; though post-tax, they may be deductible if you itemize on your return. See the IRS Charitable Contributions Guide.

Comparison Table: 2025 Payroll Deductions Overview

| Deduction | Type | Pre/Post-Tax | 2025 Limit/Rate | Tax Benefit |

| Federal Income Tax | Mandatory | — | 10–37 % | Reduced by pre-tax benefits |

| Social Security | Mandatory | — | 6.2 % to $176,100 | None |

| Medicare | Mandatory | — | 1.45 % (+ 0.9 % high-income) | None |

| State & Local Tax | Mandatory | — | 0–13.3 % | None |

| 401(k) Traditional | Voluntary | Pre-Tax | $23,500 | Tax-deferred growth |

| Roth 401(k) | Voluntary | Post-Tax | $23,500 | Tax-free withdrawals |

| HSA | Voluntary | Pre-Tax | $4,300 / $8,550 | Triple tax advantage |

| FSA | Voluntary | Pre-Tax | $3,300 | Tax savings |

| Dependent Care FSA | Voluntary | Pre-Tax | $5,000 | Tax savings |

| Health Premiums | Voluntary | Pre-Tax | Varies | Tax savings |

| Commuter Benefits | Voluntary | Pre-Tax | $325/mo each | Tax savings |

| Group Life ≤ $50k | Voluntary | Pre-Tax | N/A | Tax savings |

| Union Dues | Voluntary | Post-Tax | Varies | None |

| Garnishments | Mandatory | Post-Tax | 15–60 % | None |

Key Takeaways

- Payroll deductions fall into two categories: mandatory and voluntary.

- FICA taxes (Social Security + Medicare) total 7.65 %, matched by employers.

- Pre-tax deductions like 401(k), HSA, and FSA can lower taxable income and boost benefits.

- Post-tax deductions (such as Roth 401(k) and charitable giving) offer long-term value even without immediate tax savings.

- Staying compliant with IRS and state rules is essential for accurate payroll and employee trust.

About SkillDeck

At Skilldeck, we simplify complex payroll and HR concepts so employers and employees can focus on what truly matters — people, not paperwork. Our mission is to help organizations understand compliance, payroll accuracy, and workforce efficiency through clear, actionable insights.

FAQs on Types of Payroll Deductions in the United States

1. How do pre-tax and post-tax deductions differ?

Pre-tax deductions are withheld from an employee’s gross pay before federal, state, and FICA taxes are calculated. Because they lower taxable income, they can reduce the amount of taxes an employee owes. Examples include traditional 401(k) contributions, health insurance premiums, HSAs, FSAs, and commuter benefits.

Post-tax deductions occur after taxes have been calculated and do not reduce taxable income. These may include Roth retirement contributions, union dues, wage garnishments, supplemental life insurance, and charitable contributions.

2. Are payroll deductions the same in every state?

No. While federal payroll deductions apply nationwide, state and local deductions vary. Some states do not impose income tax at all, while others have multiple tax brackets or local taxes on wages. Employers must follow the laws specific to the state and locality where the employee works.

3. What is FICA and how does it affect payroll deductions?

FICA (Federal Insurance Contributions Act) consists of mandatory Social Security and Medicare taxes withheld from employee wages. Employees pay 6.2% for Social Security (up to the annual wage base limit) and 1.45% for Medicare with no income limit. Employers must match these contributions. Employees earning above the federal threshold may also owe the additional 0.9% Medicare tax.

4. How are court-ordered deductions handled in payroll?

Court-ordered deductions, also known as wage garnishments, must be withheld when mandated by a legal order. Common garnishments include child support, alimony, tax levies, and student loan repayment. Employers are required to deduct and remit these payments in the sequence defined by law. Child support garnishments can range from 50% to 65% of disposable income, depending on the employee’s circumstances.

5. Can employees opt out of voluntary payroll deductions?

Yes. Voluntary deductions require employee authorization and may be changed or discontinued at the employee’s request, unless restricted by program rules or contract terms (e.g., certain union agreements). Voluntary deductions may include retirement plan contributions, health benefits, HSAs/FSAs, and other elective benefits.

6. How can employees review or verify their payroll deductions?

Employees can review deductions on their pay stub or through an employer’s payroll or HR system. A pay stub typically shows gross pay, pre-tax and post-tax deductions, taxes withheld, and net pay. If discrepancies exist, employees should contact payroll or HR for clarification or correction.

7. Are employer contributions considered payroll deductions?

No. Payroll deductions apply to amounts withheld from an employee’s pay. Employer contributions such as 401(k) matching or employer-funded HSA contributions, do not reduce an employee’s wages and are not considered deductions. However, certain accounts have combined IRS contribution limits that include both employee and employer amounts.

8. What happens if payroll deductions are calculated incorrectly?

Incorrect deductions can lead to inaccurate pay, incorrect tax reporting, compliance issues, and potential penalties. Employers must correct errors promptly, which may include adjusting future payroll, refunding overpayments, recouping under-withheld amounts, and issuing corrected tax documents if required.

9. How do payroll deductions affect take-home pay?

Payroll deductions reduce an employee’s gross pay to arrive at net (take-home) pay. Pre-tax deductions reduce taxable wages, lowering tax liability. Post-tax deductions reduce the remaining amount after taxes have been applied. The combination of these deductions determines the final amount the employee receives each pay period.