When freshers or early-career professionals see a job offer labeled “Third-Party Payroll”, the first reaction is often hesitation. I’ve seen this reaction many times—questions about job security, legality, growth, and whether such roles are “temporary” or “less valued.” I had similar doubts when I first worked closely with third-party payroll teams.

From my experience, third-party payroll jobs are one of the most misunderstood employment models in India. Many people assume they are unstable or purely contractual in nature. The reality is very different. Third-party payroll roles are structured, compliant, and widely used by large organizations to manage workforce scale, compliance, and operational efficiency.

This blog draws from my direct experience handling third-party payroll roles and observing how they function within large organizations. The aim is to help HR freshers, finance graduates, and working professionals understand what third-party payroll jobs really involve, how they function in India, and how they can fit into a long-term career plan.

What Is a Third-Party Payroll Job? (Meaning)

A third-party payroll job is an employment arrangement where an individual works at a client organization but is officially employed by a payroll service provider. The payroll provider manages salary processing, statutory deductions, compliance filings, and employment documentation, while the client company manages daily work responsibilities.

In simple terms:

- The payroll company is the legal employer

- The client company is the place where the employee works

According to industry explanations such as those outlined by payroll service providers like Superworks and SG CMS, third-party payroll is designed to reduce administrative burden while maintaining full legal compliance with labour laws.

From my experience, employees often forget they are on third-party payroll after a few months because daily reporting, team interaction, and performance expectations are entirely driven by the client organization.

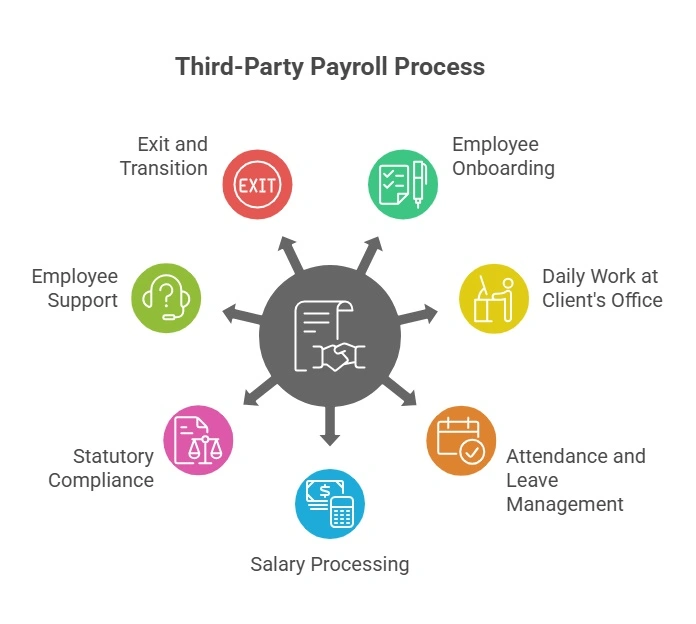

How Does Third-Party Payroll Work?

Third-party payroll follows a clearly defined operational flow. Understanding this structure helps remove most doubts around safety and legitimacy

Based on my experience working with multiple payroll partners and client HR teams, the process usually follows a predictable structure.

Hiring and Offer Issuance

The hiring requirement usually comes from the client company. They can conduct interviews directly or involve the payroll vendor during screening. Once the candidate is finalized, the offer letter and appointment documents are issued by the payroll company, not the client.

This offer letter clearly mentions:

- Salary structure

- Payroll employer details

- Notice period

- Statutory benefits

- Work location (client site)

At this stage, employees become legal employees of the payroll vendor, even though their role exists within the client’s team.

Employee Onboarding and Documentation

Payroll provider handles onboarding after the candidate accepts the offer. This includes collecting and verifying:

- Identity and address proof

- PAN and Aadhaar

- Bank account details

- PF nomination and ESI forms (where applicable)

- Educational and employment records

Accurate documentation here is important. From what I’ve seen, most payroll-related issues arising later like PF mismatches or tax errors, start with incorrect onboarding data.

Daily Work at the Client’s Office

This is where confusion often arises. Even though salary comes from the payroll vendor, all daily work happens under the client company’s supervision.

Employees:

- Report to client managers

- Follow client working hours and holidays

- Use client systems, tools, and email IDs

- Work alongside direct payroll employees

In practice, there is no difference in day-to-day responsibilities between third-party payroll staff and direct employees. This setup is one of the biggest learning advantages, especially for freshers.

Attendance, Leave, and Input Collection

Attendance and leave data are usually captured through the client’s systems. These inputs are then shared with the payroll vendor every month.

The payroll team validates:

- Working days

- Overtime or shift allowances

- Leave balances

- Loss of pay entries

This coordination between client HR and the payroll provider ensures salary accuracy and compliance.

Salary Processing and Payslip Generation

Once inputs are finalized, the payroll vendor processes salaries. This includes:

- Gross salary calculation

- Statutory deductions (PF, ESI, professional tax, TDS)

- Net salary computation

- Payslip generation

Salaries are credited directly to employee bank accounts from the payroll vendor’s account. Payslips are issued monthly and serve as official income proof, just like company payroll payslips.

Statutory Compliance and Government Filings

Compliance management is one of the main reasons for companies to use third-party payroll. Payroll vendors handle:

- EPF contributions and filings

- ESI deposits

- Income tax deductions and TDS returns

- Professional tax filings

- Labour law registers and reports

From an employee’s point of view, this means statutory benefits remain intact, provided the vendor is compliant and registered

Employee Queries and Support

Payroll vendors offer support for:

- Payslip queries

- tax declarations

- PF and ESI issues

- Form 16

- Exit formalities

Client HR teams coordinate closely when transitions or exits occur.

In well-managed setups, query resolution timelines and escalation processes are clearly defined, which avoids confusion for employees.

Exit, Transition, or Absorption

When a project ends or an employee resigns, the payroll vendor handles:

- Full and final settlement

- Experience and relieving letters

- Statutory exit formalities

In many cases, high-performing employees are absorbed into the client’s direct payroll, especially when roles become permanent. I’ve personally seen this happen across IT services, shared services, and operations teams.

How This Model Helps Employees Learn Faster

Working under third-party payroll exposes professionals to:

- Live HR and payroll systems

- Real compliance processes

- Client interaction and reporting

- Corporate discipline and audits

This practical exposure is why many professionals use third-party payroll jobs as stepping stones into permanent roles in HR, payroll, HRIS, or compliance-focused areas.

Examples of Third-Party Payroll Jobs

Third-party payroll is not limited to junior roles. It spans across functions, levels, and even technical domains.

Entry-Level Roles

| Role | Typical Responsibilities |

| Payroll Executive | Attendance checks, salary inputs |

| HR Operations Executive | Onboarding, documentation |

| Data Entry Operator | Payroll and HR data updates |

| Compliance Assistant | PF, ESI coordination |

These roles are common entry points for HR freshers and commerce graduates.

Mid-Level Roles

| Role | Typical Responsibilities |

| Payroll Analyst | Salary validation, reconciliations |

| HR Coordinator | Client and vendor coordination |

| Payroll Specialist | Compliance accuracy, audits |

| MIS Executive | Payroll reporting and dashboards |

From what I’ve seen, professionals at this level start gaining domain authority.

Advanced and Technical Roles

| Role | Typical Responsibilities |

| HRMS Support Analyst | Payroll system support |

| Implementation Executive | Payroll setup for new clients |

| Database Developer | Payroll data systems |

| Team Lead | Managing payroll teams |

Large employers such as Accenture, Amazon, and global BPO firms regularly hire for such roles through third-party payroll models.

Third-Party Payroll vs Company Payroll

Understanding the difference helps professionals make informed choices.

| Aspect | Company Payroll | Third-Party Payroll |

| Legal Employer | Client company | Payroll vendor |

| Salary Processing | Internal HR | External provider |

| Compliance | Internal responsibility | Vendor-managed |

| Work Location | Client office | Client office |

| Entry Speed | Slower | Faster |

| Exposure | One system | Multiple systems |

From my experience, third-party payroll often offers faster access to large organizations, especially for freshers.

Pros and Cons of Third-Party Payroll Jobs

Third-party payroll jobs offer several practical benefits:

Pros

Faster Hiring Cycles

Third-party payroll roles usually close faster since companies can onboard through vendors without long approval processes. This helps candidates start working quickly, especially when immediate income or experience matters.

Exposure To Large Corporate Environments

Many of these roles place employees inside well-known IT firms, MNCs, or large operational setups. This gives firsthand experience with structured processes, reporting systems, and corporate work culture.

Hands-on Learning Of Real HR and Payroll Operations

From attendance validation to compliance coordination, these roles offer direct involvement in day-to-day HR and payroll tasks. Learning happens on live systems rather than simulations or theory.

Stable Monthly Income

Salaries are processed on fixed cycles with documented payslips and statutory deductions. For freshers or job switchers, this stability helps manage finances while gaining experience.

Clear Statutory Compliance

Reputed payroll vendors handle PF, ESI, TDS, and legal filings as per regulations. This gives employees formal employment records that support future job transitions.

I’ve seen many professionals use these roles as stepping stones into permanent or specialized positions.

Cons

There are also constraints to consider:

Promotions Depend On Client Absorption Policies

Career progression often depends on whether the client company converts third-party employees into direct roles, which may take time or depend on business needs.

Benefits May Differ From Direct Payroll Staff

Certain allowances, bonuses, or internal programs may be limited compared to permanent employees, even when daily responsibilities are similar.

Role Continuity Depends On Client Contracts

If a project ends or contracts change, roles may shift or require redeployment through the payroll vendor.

Most of these issues are reduced when the payroll vendor is well-established and transparent.

Is a Third-Party Payroll Job Safe and Legal in India?

Yes. Third-party payroll jobs are fully legal in India when operated in accordance with the law.

Payroll providers must comply with:

Payment of Wages Act

Salaries must be paid within prescribed timelines, usually before the 7th or 10th of the following month, depending on workforce size. Payroll providers must ensure that no unauthorized deductions are made and issue clear salary statements to employees.

Employees’ Provident Fund Act (EPF)

For eligible employees, payroll providers must calculate and deposit both employee and employer PF contributions within due dates. Accurate wage ceilings, contribution rates, and monthly filings with EPFO are mandatory.

Employees’ State Insurance Act (ESI)

For employees covered under ESI, payroll providers must handle contribution calculation, monthly deposits, and submission of returns. This ensures access to medical and social security benefits for eligible workers.

Income Tax Act

Payroll providers must calculate TDS on salaries, deposit tax amounts with the government, file quarterly TDS returns, and issue Form 16 to employees. Errors or delays can lead to penalties for both the employer and the provider.

State Professional Tax Laws

Professional tax rules differ by state. Payroll providers must deduct the correct amount based on employee salary slabs and submit payments to state authorities within deadlines.

From my experience, most risks arise only when employees ignore documentation or fail to verify PF and payslip details.

Who Should Choose a Third-Party Payroll Job?

Third-party payroll roles suit:

- Fresh graduates seeking practical exposure

- Professionals needing immediate income

- Candidates targeting IT majors and large firms

- Individuals entering HR, finance, or operations

- People transitioning between careers

I’ve personally seen many candidates build confidence and credibility through these roles.

Skills Required for Third-Party Payroll Roles

Technical Skills

Payroll Calculation

Ability to calculate gross pay, deductions, and take-home salary correctly based on attendance, salary structure, and statutory rules.

PF, ESI, TDS Basics

Working knowledge of Provident Fund, Employee State Insurance, and income tax deductions, including eligibility limits, contribution percentages, and monthly filing timelines.

Excel and HRMS Tools

Comfort with Excel formulas, filters, and basic reports, along with regular use of HRMS or payroll software for attendance tracking and salary processing.

Data Validation

Practice of checking employee details, salary inputs, and statutory data to reduce errors during payroll processing.

Professional Skills

Accuracy And Discipline

Consistent focus on correctness while following payroll schedules, checklists, and internal processes.

Time-bound Task

Ability to complete payroll activities within fixed cycles and meet salary deadlines without delay.

Clear Communication

Skill in explaining salary components, deductions, and payroll queries simply and directly.

Confidential Data Handling

Careful handling of employee salary details, bank information, and tax records to maintain privacy and trust.

In my experience, consistency and reliability matter more than advanced qualifications at the early stage.

Career Growth in Third-Party Payroll Jobs

Career growth depends on skill depth and system exposure.

Career Progression Table

| Experience | Typical Role |

| 0–2 years | Payroll Executive |

| 2–5 years | Payroll Analyst |

| 5–8 years | Team Lead |

| 8+ years | Payroll Manager |

Professionals often move into HRIS, compensation, global payroll, or consulting roles, as discussed by Valor Payroll Solutions.

Common FAQs About Third-Party Payroll Jobs

1. Are third-party payroll employees contract workers?

No. They are full-time employees of the payroll vendor with statutory benefits and formal appointment letters.

2. Can third-party payroll employees become permanent staff?

Yes. Many organizations absorb high performers based on role continuity and business needs.

3. Are PF and ESI mandatory in third-party payroll?

Yes. PF, ESI, and TDS deductions are mandatory and handled by compliant payroll vendors.

4. Is salary growth limited in third-party payroll jobs?

Growth depends on skill level and role complexity. Strong experience leads to better opportunities.

5. Are third-party payroll jobs stable?

They are stable when linked to ongoing projects and reputable payroll providers.

6. How do I verify a payroll vendor?

Check statutory registrations, PF portal entries, payslips, and appointment letters before joining.

Conclusion

Third-party payroll jobs are often misunderstood, yet they offer real exposure, compliance-backed employment, and steady income. From my experience, these roles help professionals understand workplace systems, payroll processes, and compliance faster than many entry-level corporate jobs.

Third-party payroll can serve as a structured starting point for freshers, job seekers, and professionals entering HR or finance. When approached with clarity and learning intent, these roles support long-term career growth rather than limiting it.

If your goal is experience, stability, and skill development, third-party payroll jobs deserve serious consideration—not hesitation.

Ready to build a career in HR payroll? Structured learning can make a big difference.

SkillDeck’s payroll and HR certification programs is designed to help freshers and working professionals understand real payroll processes, statutory compliance, and workplace systems used in large organizations.

You can also enroll in other HR certification courses.