Payroll rarely features in popular career discussions. When students or early-career professionals talk about HR or finance roles, they often think of talent acquisition, investment banking, or analytics. Payroll is usually reduced to “salary processing.”

After working closely with payroll teams across IT, manufacturing, BFSI, startups, and third-party payroll firms in India, it becomes clear that this perception no longer reflects reality.

I have seen fresh graduates start their careers in payroll with modest salaries and limited expectations. Within a few years, many moved into payroll manager roles, compliance specialist positions, or broader HR operations leadership. Leadership teams rely on payroll data during audits, mergers, salary revisions, and labour inspections. Payroll today sits at the centre of employee trust, statutory compliance, and business continuity.

This blog answers a question many students, HR professionals, accountants, career switchers, and small business owners ask: Is payroll a good career in India in 2026 and beyond? It covers salary expectations, career scope, growth paths, daily responsibilities, and long-term stability.

Why Payroll Is Being Considered as a Career in India

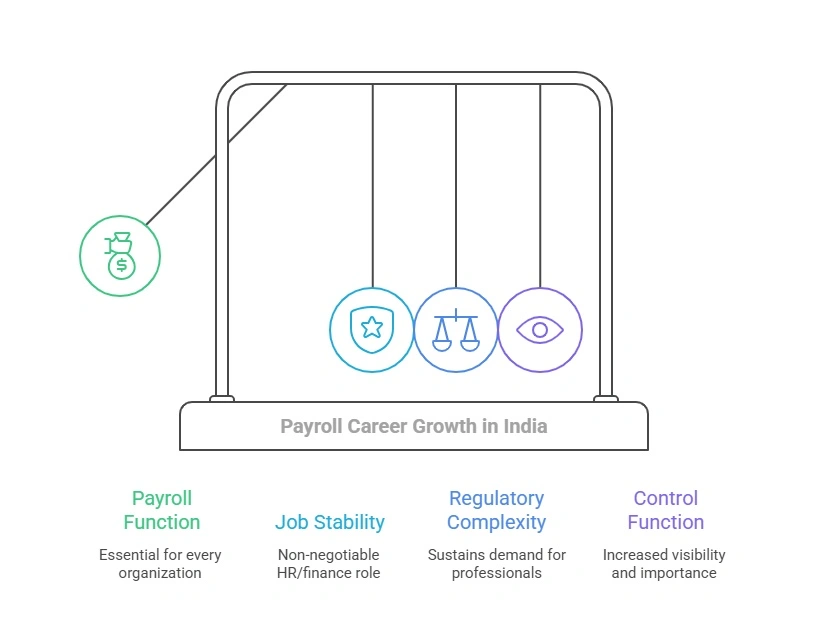

Every organisation, regardless of size or industry, must pay employees accurately and on time. This requirement does not change with market conditions or funding cycles. Payroll continues even when hiring slows or business priorities shift.

Business Necessity and Job Stability

Payroll is a non-negotiable function. Organisations may restructure departments, but payroll processing, statutory filings, and tax payments cannot stop. This makes payroll one of the more stable roles within HR and finance teams.

Industry data from the India payroll services market shows steady growth, supported by formalisation of employment and increased outsourcing by SMEs and startups.

Regulatory Complexity Sustains Demand

Indian payroll involves income tax, provident fund, ESI, professional tax, labour welfare fund, and state-specific labour laws. These regulations change frequently and vary by geography. Software supports calculations, but interpretation and compliance decisions depend on trained professionals.

Shift From Back-Office to Control Function

Payroll teams now handle audits, inspections, reconciliations, and employee escalations. Their work directly affects legal compliance and employee confidence. This responsibility has increased the visibility and importance of payroll roles inside organisations.

What Does a Payroll Professional Do?

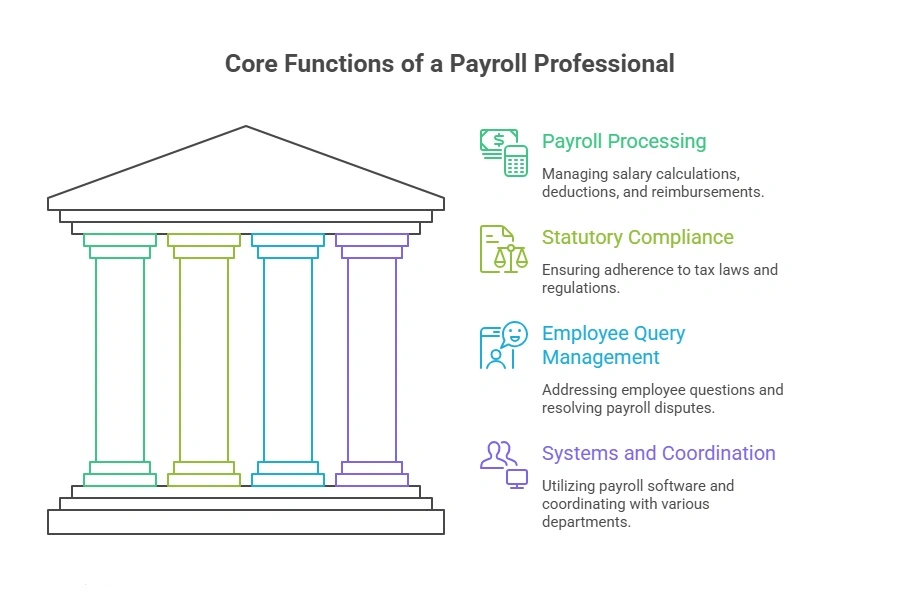

A payroll professional’s role touches multiple parts of the organisation. It combines operational accuracy, legal awareness, system usage, and regular interaction with employees, managers, and external authorities.

Payroll work extends far beyond generating payslips. It combines accuracy, compliance knowledge, system handling, and coordination across teams.

Payroll Processing Responsibilities

Payroll professionals manage monthly salary calculations, overtime, incentives, deductions, and reimbursements. They review attendance data, leave balances, and variable pay inputs to catch gaps or inconsistencies before payroll is locked. This step reduces salary errors, rework, and employee escalations after payslips are released.

Statutory Compliance and Reporting

A major part of payroll involves statutory filings such as PF, ESI, and TDS. Payroll teams prepare challans, file returns, issue Form 16, and track due dates to avoid penalties, as outlined in standard payroll job responsibilities across Indian organisations. They maintain clean documentation and registers that are reviewed during inspections, internal audits, and statutory audits.

Employee Query Management

Payroll professionals respond to employee questions related to payslips, tax deductions, final settlements, and benefits. They explain calculations in simple terms, correct genuine errors, and close queries within payroll timelines. Consistent resolution builds confidence and reduces recurring payroll disputes.

Systems and Coordination

Modern payroll relies on payroll software, HRMS platforms, and Excel-based controls. Payroll teams test system changes, reconcile reports, and coordinate with HR, finance, auditors, and vendors. This coordination ensures data accuracy across systems and supports smooth month-end and year-end closures.

Payroll Salary in India (2026 Outlook)

Payroll salaries vary based on experience, industry, location, and scope of responsibility.

Salary by Experience Level

| Experience Level | Annual Salary Range |

| Entry Level (0–2 years) | ₹2.1 – ₹4.5 LPA |

| Mid Level (3–5 years) | ₹4.9 – ₹7 LPA |

| Senior Level (8–10+ years) | ₹8 – ₹12+ LPA |

| Payroll Manager / Lead | ₹14 – ₹30+ LPA |

Entry-level roles focus on execution and learning, similar to the responsibilities described for payroll administrators in global HR practice. Mid-level professionals handle end-to-end payroll cycles. Senior professionals manage teams, audits, and complex compliance.

Location-Based Differences

Metro cities such as Bengaluru, Mumbai, Delhi NCR, and Chennai offer higher payroll salaries due to multi-state payroll complexity and the presence of large enterprises.

Salary Growth Trends

India is projected to see average salary growth of around 9% in 2026, according to recent compensation outlooks reported by NDTV and industry surveys. Payroll professionals often benefit directly as they support salary structuring and compliance execution.

Career Growth Path in Payroll

Payroll offers a clear and structured career path, which is one of the reasons many professionals stay in this function long-term. Growth in payroll is driven by responsibility, compliance depth, system expertise, and the ability to handle scale.

Entry-Level Roles

Most professionals begin as Payroll Executives, Payroll Coordinators, or Payroll Trainees. At this stage, the focus is on learning how payroll operates in a real organisational setting. Responsibilities usually include validating attendance data, updating employee records, supporting monthly payroll runs, and assisting with basic statutory calculations under supervision.

This phase is critical for building accuracy, discipline, and familiarity with payroll cycles. Freshers also learn how payroll timelines work, how errors are corrected, and how payroll teams coordinate with HR and finance.

Early to Mid-Level Roles

With two to four years of experience, professionals move into Payroll Specialist or Payroll Analyst roles. Here, ownership increases significantly. Professionals handle end-to-end payroll processing for assigned employee groups, manage PF, ESI, and TDS filings, prepare MIS reports, and support audits.

At this stage, payroll professionals often become the first point of contact for complex employee queries and internal escalations. Strong statutory knowledge and system confidence at this level directly influence career progression and compensation growth.

Leadership Roles

Payroll Managers and Leads usually emerge after five to seven years of experience. Their role shifts from execution to oversight and risk control. Responsibilities include managing payroll teams, reviewing payroll outputs, coordinating with auditors, handling government inspections, and ensuring compliance across locations.

Payroll Managers also work closely with HR and finance leadership during salary revisions, restructures, mergers, and policy changes. Many professionals at this stage expand into broader HR operations or compensation-related responsibilities.

Advanced Career Options

With senior experience, payroll professionals can move into specialised or strategic roles such as Global Payroll Lead, Compensation and Benefits Manager, Payroll Technology Consultant, or Compliance Specialist. These roles involve handling multi-country payrolls, designing salary structures, leading system implementations, or managing regulatory strategy.

Professionals with strong system and compliance expertise may also move into consulting or advisory roles, supporting organisations during payroll transitions, audits, or expansion phases.

Scope of Payroll Careers Across Industries

Payroll demand in India is strongly industry-driven, shaped by workforce size, compliance load, and pay structure complexity. Payroll roles remain active across both service and traditional sectors.

IT & ITES

Continue to lead payroll hiring. Large employee bases, variable pay, ESOPs, shift allowances, and global reporting requirements increase payroll headcount and system dependency.

BFSI

Payroll teams handle strict compliance, audit readiness, and regulated compensation structures. Accuracy and statutory control are prioritised due to regulatory scrutiny.

Manufacturing & Engineering

Payroll involves multi-location compliance, contract labour management, overtime, and factory-related labour laws, creating steady demand for experienced payroll professionals.

Retail & E‑commerce

Payroll focuses on high-volume processing, attrition handling, incentives, and shift-based pay. Scale and speed define payroll roles here.

Healthcare & Pharmaceuticals

Require payroll teams to manage regulated pay structures, professional allowances, and inspection-ready documentation.

Education & Institutional Sectors

Rely on payroll for grant-linked pay structures, contractual faculty payments, and statutory reporting, offering stability and predictable payroll cycles.

The scope of payroll careers in India is broader than many candidates initially expect. Payroll roles exist across industries, organisation sizes, and employment models, making this function adaptable and resilient over time.

Payroll professionals are required across sectors such as IT, BFSI, manufacturing, retail, healthcare, and education. IT and ITES lead demand due to complex pay structures and global payroll needs.

In-House and Third-Party Payroll Roles

Payroll careers in India typically fall into two models: in-house payroll teams and third-party payroll service providers. Each offers a different type of exposure and career learning.

In-house payroll professionals work directly within an organisation and handle payroll for a single company. Their role involves deeper alignment with internal HR policies, compensation structures, audits, and leadership reporting. Over time, this path builds strong organisational context and long-term ownership.

Third-party payroll firms manage payroll for multiple clients across industries, a model increasingly adopted as seen in the growth of payroll outsourcing companies in India. These roles offer faster learning, exposure to varied payroll scenarios, and strong statutory practice. Many professionals start in third-party payroll to build foundations, then transition into in-house or leadership roles as their careers progress.

Third-party payroll firms handle payroll for multiple organisations, offering faster exposure and learning. Many professionals later move into in-house leadership roles.

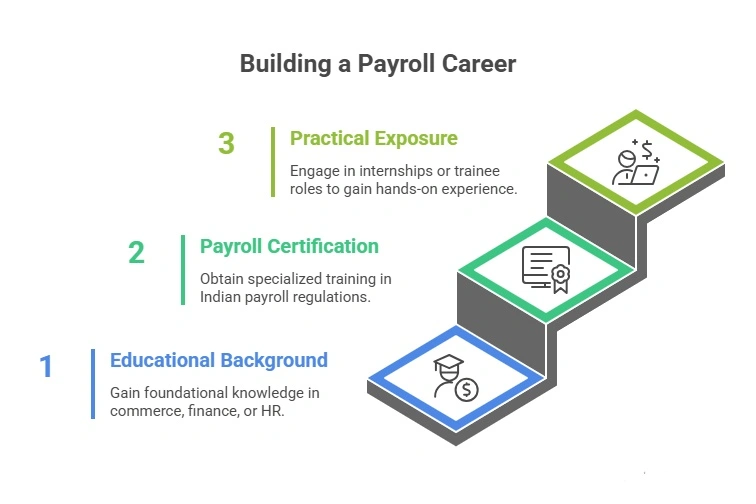

How to Start a Career in Payroll in India

Starting a payroll career does not require a linear or rigid path. What matters more is building basic statutory understanding, system exposure, and hands-on experience early.

Educational Background

Degrees in commerce, finance, accounting, or HR help, as they introduce concepts like taxation, salary structures, and compliance. That said, payroll professionals also come from science, arts, or engineering backgrounds and transition successfully by learning payroll fundamentals on the job.

Basic comfort with numbers, Excel, and documentation plays a bigger role than the degree title itself.

Payroll Certification Course

A payroll certification course helps bridge the gap between theory and workplace expectations, especially for roles similar to those listed on payroll job listings in India. A course introduces Indian salary structures, income tax calculations, PF, ESI, and common payroll scenarios.

For freshers and career switchers, a payroll certification signals seriousness and job readiness. For working professionals, it helps strengthen compliance confidence and improve role mobility.

Importance of Practical Exposure

Practical exposure shapes payroll careers faster than classroom learning alone. Internships, trainee roles, or third-party payroll jobs provide exposure to live payroll cycles, statutory filings, employee queries, and audits.

This early hands-on experience builds process discipline, confidence, and clarity on whether payroll suits long-term career goals.

Is Payroll a Future-Proof Career in India?

Payroll remains stable as long as formal employment exists. Automation supports processing but does not remove accountability, compliance responsibility, or human judgment.

Technology has shifted payroll work toward validation, exception handling, audits, and reporting, reflecting broader payroll technology trends in India. Regulatory changes and labour reforms continue to increase payroll complexity rather than reduce it.

Payroll professionals who stay updated with laws, systems, and reporting standards continue to see steady demand.

Frequently Asked Questions (FAQs)

Is payroll a good career for freshers in India?

Yes. Payroll offers structured learning, stable demand, and early exposure to compliance, systems, and audits. Freshers gain practical experience quickly, which supports steady career growth in HR operations, compliance, or payroll leadership roles.

Can payroll professionals switch to other HR or finance roles later?

Yes. Many payroll professionals move into HR operations, compensation and benefits, compliance, or finance operations roles. Payroll builds strong fundamentals in data handling, statutory laws, and cross-team coordination.

Will automation reduce payroll jobs in the future?

Automation supports calculations and reporting, but accountability, compliance checks, audits, and exception handling still require trained professionals. In India, frequent regulatory changes continue to sustain payroll demand.

What skills matter most for payroll careers?

Statutory knowledge, Excel proficiency, payroll software handling, attention to detail, and communication skills matter most. As experience grows, audit handling and system implementation exposure add career value.

Is third-party payroll experience valued?

Yes. Third-party payroll roles offer exposure to multiple clients, industries, and compliance scenarios. This experience is widely accepted and often helps professionals move into in-house or leadership positions.

Do payroll certifications improve job prospects?

Payroll certifications improve statutory understanding and job readiness, especially for freshers and career switchers. They help employers assess compliance knowledge and reduce on-the-job learning time.

What is the long-term growth potential in payroll?

With experience, payroll professionals grow into manager, global payroll, compliance, consulting, or HR operations leadership roles. Growth is steady for those who maintain statutory and system expertise.

Final Thoughts

Payroll offers structure, stability, and long-term relevance. It suits professionals who value accuracy, compliance knowledge, and responsibility. For freshers, payroll provides entry into core business operations. For HR and finance professionals, it offers a dependable specialisation with leadership potential.

For those willing to build statutory expertise and operational depth, payroll remains a solid career choice in India beyond 2026.