- Tenure - 8+ Hours, 1 Month Program ( weekend batch )

- Upcoming Class - April 5, 11, 12 & 18 2026 | 7 - 9PM

- Next Batch - Coming Soon

- Program Fee: 6490 INR

Reserve your seat for Upcoming Batch by filling out the form, 7 Spots Left

Live Indian Payroll System Course – Master Payroll Processing & Compliance in India

Who is this program for

For HR’s aiming to become strategic partners

Education

Graduates/Postgraduates in Commerce, Finance, Human Resources, or related fields. Foundational knowledge of payroll or compliance is an added advantage.

Work Exp.

Entry- or early-career HR professionals (0–3 years)

Career Stage

Mid to senior-level professionals

Aspirations

Achieving higher career growth

Fee & Batch Details

Invest in your future with affordable degree fees and flexible batch options

Program Fee

6490 INR (including 18% GST)

No installment plan available for this program

Limited time offer ₹12999

Batch Details

Date for 1st Class: April 5, 11, 12 & 18 2026

Seats On First Come- First Serve Basis.

Build your profile with the latest trend and get easily placed in Top Corporates

Our Course Certificates are trusted by these industry leaders

Build Your Resume

Build your profile with the latest trend and get easily placed in Top Corporates

Explore our Syllabus

What you will learn:

- What is Payroll? Scope & objectives

- Indian payroll workflow overview

- Stakeholders in payroll (HR, finance, employees, statutory bodies)

- Types of employees and pay cycles (monthly, weekly, daily)

- Understanding CTC, Gross, Net, and In-hand salary

- Detailed explanation of salary heads:

- Basic

- HRA

- Special Allowance

- LTA

- Conveyance

- Medical Reimbursement

- Bonus, Incentives, and Variable Pay

- Perquisites: Rent-free accommodation, company car, food coupons, etc.

- Designing a compliant and tax-efficient salary structure

- Comparison of old vs new regime slabs

- Allowed exemptions under the Old Regime:

- HRA

- Section 80C (LIC, PPF, PF, etc.)

- 80D (Medical Insurance), 80G, 24(b) (Home Loan Interest)

- No exemption scenario in New Regime

- Which regime is better for whom – real-life scenarios

- Tax planning tips for payroll professionals

- Calculation of monthly and annual income tax

- Use of slab rates for different age groups (below 60, 60–80, above 80)

- Standard deduction, professional tax, and surcharge

- TDS deduction logic

- Advance tax, rebate under Section 87A

TDS challan 281, Form 16, and Form 24Q basics

- Provident Fund (PF) – applicability, employer/employee contributions, UAN

- Employee State Insurance (ESI) – wage limits, IP number, benefits

- Professional Tax – state-wise slab overview

- Labour Welfare Fund (LWF) – applicability by state

Gratuity & Bonus – eligibility, calculation methods, compliance

- Monthly payroll processing steps

- Creating salary slips manually and using templates

- Generating salary registers and reconciliation sheets

- Full & Final (F&F) settlement: leave encashment, notice pay, recovery

- Leave policy, encashment rules, LOP calculation

- Creating salary sheets in Excel with formulae

- Auto-calculating gross, deductions, net pay

- Attendance to payroll linkage

- Template for F&F, salary slip, and payroll register

- TDS workings and monthly payroll summary

- Razorpay Payroll setup and dashboard overview

- Adding employees and configuring salary structures

- PF, ESI, PT setup in Razorpay

- Payslip generation

- TDS and compliance filing via Razorpay

- Benefits of cloud-based payroll processing

- Payroll MIS Reports

- Payroll audit checklist

- Monthly and annual statutory returns

- Payroll documentation for audit & record keeping

- Data privacy and payroll confidentiality

- Payroll processing of a 10-employee dummy organization

- Calculation of income tax under both regimes

- Generating salary slips and Excel salary sheet

- Final quiz and evaluation

Interested in Payroll Management Course?

Course Overview

Why SkillDeck?

- Globally recognised Platform

- DIPP, ISO, MSME from Govt of India

- Globally accepted certification

- Lifetime Recording accessibility

- Join 40,000+ members worldwide

- Career Guidance

Trained

5,00,000

Live Classes/Month

500+

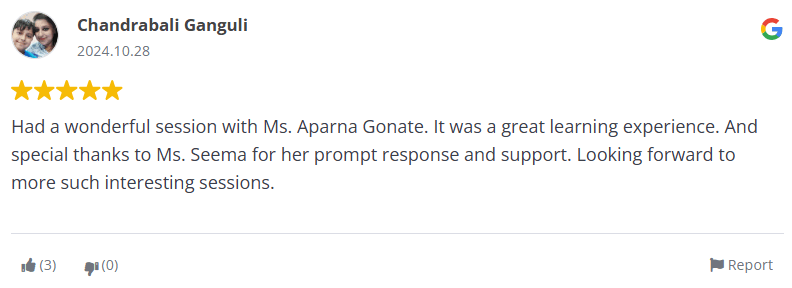

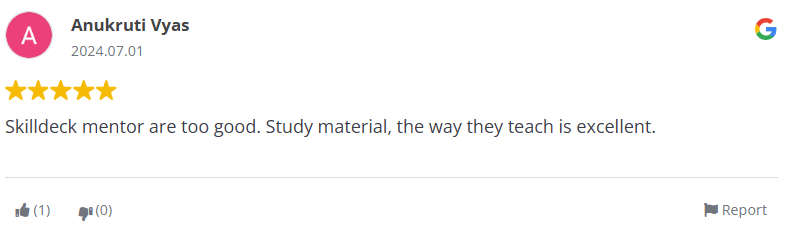

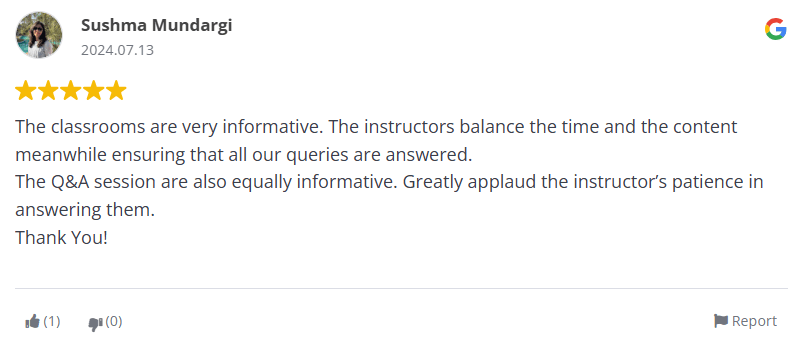

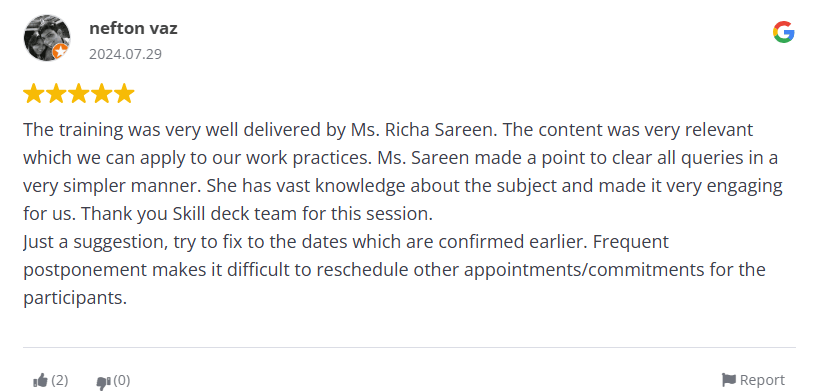

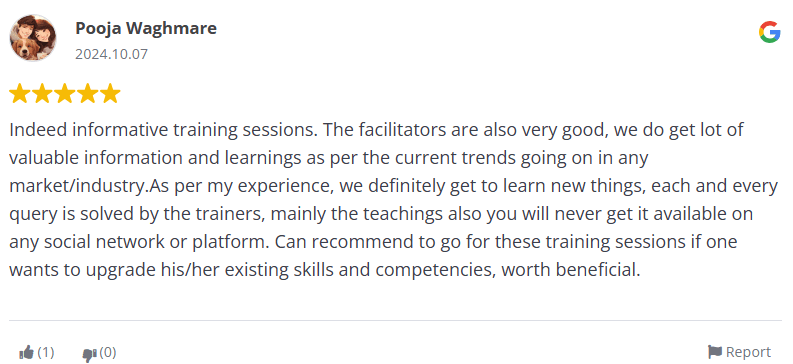

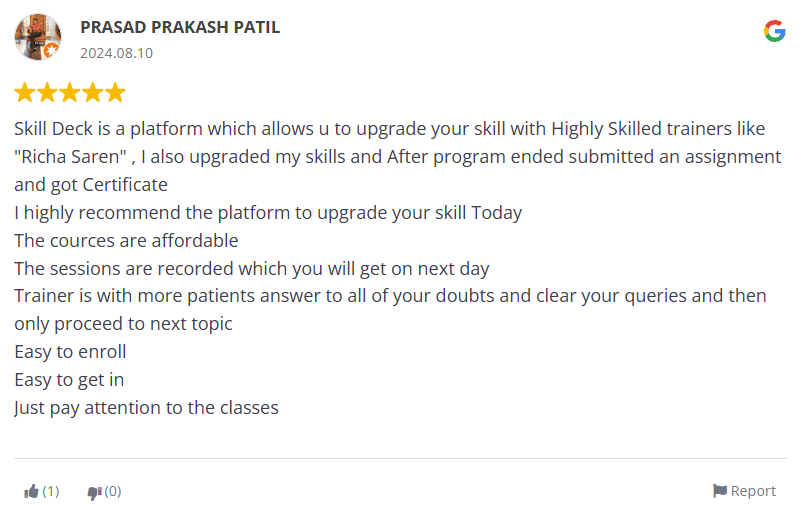

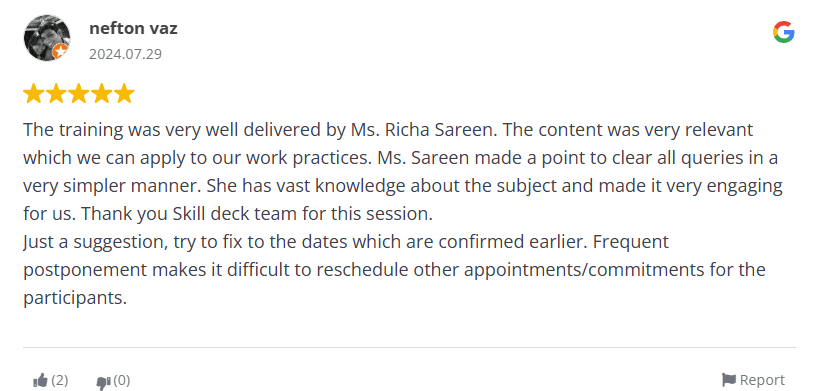

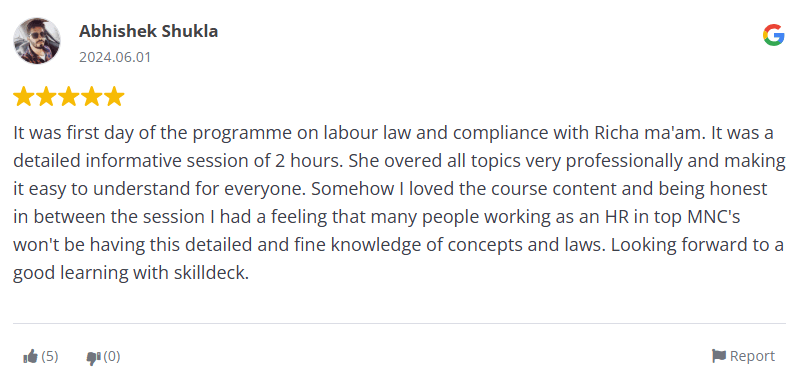

Google Reviews

1000+

Corporate Partners

50+

College Partner

90+

career benefits

91%

Pricing

₹5,000 ₹12999

- Certified & Experienced Instructors

- Flexible Schedule

- Masterclasses By Skill Deck®️

- Placement Assistance

- Access to the Recorded Sessions

- Live-Online Training

- Tailor Made Training

- 4 in 1 Program

- Globally recognised Platform

Meet Your Trainer

Richa Sareen

About the Trainer – Richa Sareen

Richa Sareen brings over 18 years of hands-on experience in Human Resources, having held strategic roles including HR Director and Head of Talent Acquisition across leading organizations. She is the Founder of SkillDeck, a premium HR consulting and training platform, where she has successfully trained and mentored over 5,000 HR professionals across India and abroad.

Richa’s programs are known for their practicality, industry relevance, and case study-based approach, covering everything from labor laws and HR audits to payroll, PMS, and strategic HR partnering. Her training is deeply rooted in real-time experience, making it easy for professionals to implement the learnings from day one.

🏆 Recognized Excellence:

SIWAA Award Winner – For outstanding contribution in HR training

IHRC Award – For Innovation in Human Resource Consulting

IEA Award – For Excellence in Employee Engagement & HR Solutions

🎥 She is also a well-known HR content creator on YouTube, simplifying complex HR topics like manpower planning, compliance, and Boolean search sourcing using real tools, templates, and examples. rephrase in small

Indian Payroll And Taxation Compliance Mastery Certification Process

Counseling & Registration

Get in touch with our counselors to understand the course structure and select the right batch. Register for the Indian Payroll & Taxation Compliance Mastery Course.

Join the Payroll & Taxation Training

Attend live, expert-led sessions covering payroll management, statutory compliance, and taxation laws. Missed a session? Recordings are available anytime.

Submission of Projects Assigned

Complete practical assignments and real-world case studies on payroll and tax scenarios. Submit them for trainer evaluation and feedback.

Earn Certification

Post Completion of the training, get Course Completion Certification of Indian Payroll And Taxation Compliance Mastery Program from The SkillDeck®

FAQs

Curriculum is specifically engineered to meet the expectations of leading tech companies.

Yes—this course is specifically designed for HR professionals managing payroll in Indian organizations, covering:

- Payroll processing cycles and CTC structuring

- Statutory compliance: PF, ESI, PT, LWF, TDS, gratuity, bonus

- Full & final settlement processes, leave encashment, payslip generation

Real-world case studies and error handling practices

These topics match the practical demands of HR and payroll teams across sectors

Ideal for:

- Fresh graduates and MBA‑HR students

- Entry- or early-career HR professionals (0–3 years)

- Admin staff handling payroll functions

- Small business owners managing payroll in-house

- Anyone aiming to upskill in payroll compliance and operations

The pedagogy is interactive and practice‑oriented:

- Live instructor-led sessions via Zoom

- Case studies and real incidents

- Quizzes, assessments, and class exercises

- Excel-based tools for register preparation, payslip creation, TDS calculation

Class participation, mini-projects, simulations

This ensures learners gain both understanding and hands-on capability for immediate workplace application

- Course Fee: ₹5000 (plus GST)

- Includes: Live sessions, LMS access with lifetime recordings, practical tools/templates, certification

Upcoming batch in August 2025 (e.g., 8, 9, 10 August, 7–9 PM IST), subject to schedule availability

Participants receive a SkillDeck Certificate of Completion stating:

- Your name and program title (“Indian Payroll System”)

- Unique certificate ID and date of completion

- Trainer signature and SkillDeck accreditation seals

Recognized under ISO 9001:2015, DIPP, and MSME frameworks

No—it’s a live instructor-led course with real-time interaction via Zoom.

However, all sessions are recorded and made available on the LMS for flexible review and self-paced revision.

Yes. SkillDeck certifications are government-recognized and globally accepted, backed by ISO, MSME, and Department for Promotion of Industry and Internal Trade (DIPP) credentials.

This makes the certification trusted across corporates, startups, and public sector organizations