Why Payroll Course Fees Cause So Much Confusion

Payroll looks simple from the outside. Many people assume it’s about processing salaries once a month. That assumption often leads learners to choose the cheapest payroll course available, only to realise later that they’re not ready for real payroll work.

Having worked closely with payroll teams and training providers over the years, I’ve seen how payroll course fees in India vary widely—and how the value delivered varies even more. Early in my career, I enrolled in a low-cost payroll course that focused mainly on theory. It looked affordable, but it didn’t prepare me for salary structuring, statutory filings, audits, or handling real employee queries. A few years later, I invested in a slightly higher-priced program that included hands-on payroll processing, PF and ESI scenarios, compliance updates, and practical tools. That difference shaped my understanding of what payroll courses are actually worth paying for.

This guide breaks down payroll course fees in India, explains what drives those fees, compares low-cost and premium programs, and helps you decide how much to invest based on your background and career goals.

Average Payroll Course Fees in India

Payroll course fees in India generally fall into three broad ranges based on payroll course duration. Each range serves a different type of learner.

Payroll Course Fees by Duration

| Course Duration | Typical Fee Range | Who It Suits |

| 1 Month | ₹3,000 – ₹8,000 | Quick upskilling, basic understanding |

| 3 Months | ₹12,000 – ₹25,000 | Career starters, role transitions |

| 6 Months | ₹18,000 – ₹35,000 | Career switchers, job-focused learners |

Short-term courses focus on fundamentals and software basics. Longer programs spread learning across compliance, calculations, audits, and practical exposure. An interesting pattern shows up here: the monthly cost drops as duration increases. A six-month program often works out cheaper per month than a fast-track one-month course.

Programs listed on platforms like Skilldeck, reflect this pricing structure across India.

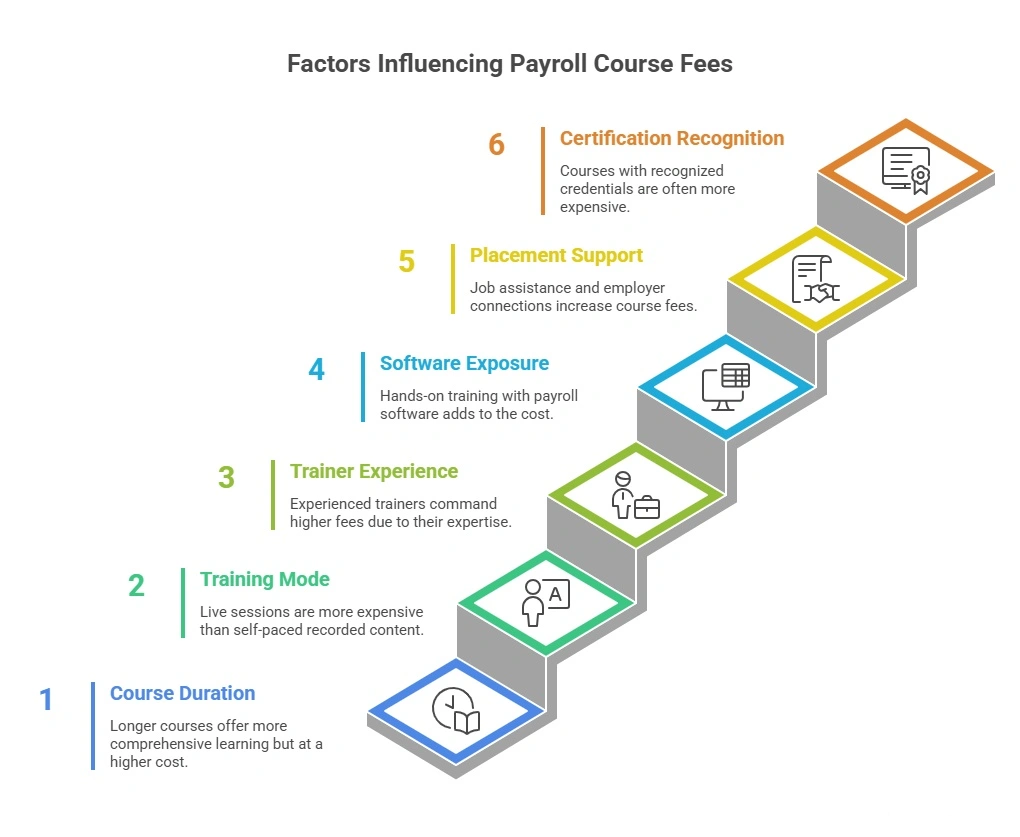

What Decides Payroll Course Fees in India?

Payroll training costs are shaped by several connected factors. Understanding these helps you judge whether a course fee is justified.

Course Duration and Learning Depth

Longer courses cost more overall but usually provide better sequencing. Learners start with salary structures and CTC components, move into statutory deductions, and later handle audits and complex scenarios. Short courses compress this learning, which works only if you already have background knowledge.

Live Training vs Recorded Content

Self-paced payroll courses on platforms like Udemy or S20 are cheaper since they rely on recorded videos. Instructor-led programs cost more due to live sessions, doubt-solving, and batch management. Live learning often makes a difference when dealing with compliance logic.

Trainer Experience

Courses led by trainers with 10–15 years of corporate payroll experience command higher fees. These trainers bring examples from real payroll cycles, inspections, and error handling that textbooks don’t cover.

Practical Software Exposure

Hands-on training using tools such as Tally Payroll, Zoho Payroll, or SAP adds to course fees due to software access and lab setup. This cost is justified, as most payroll roles expect immediate tool familiarity.

Placement and Job Support

Placement assistance remains one of the biggest cost drivers. Programs offering interview scheduling and employer connections charge more since they invest in recruiter networks and career teams.

Certification Recognition

Courses linked to recognised credentials like SkillDeck’s payroll certification program tend to sit in the mid-to-premium range due to employer recognition.

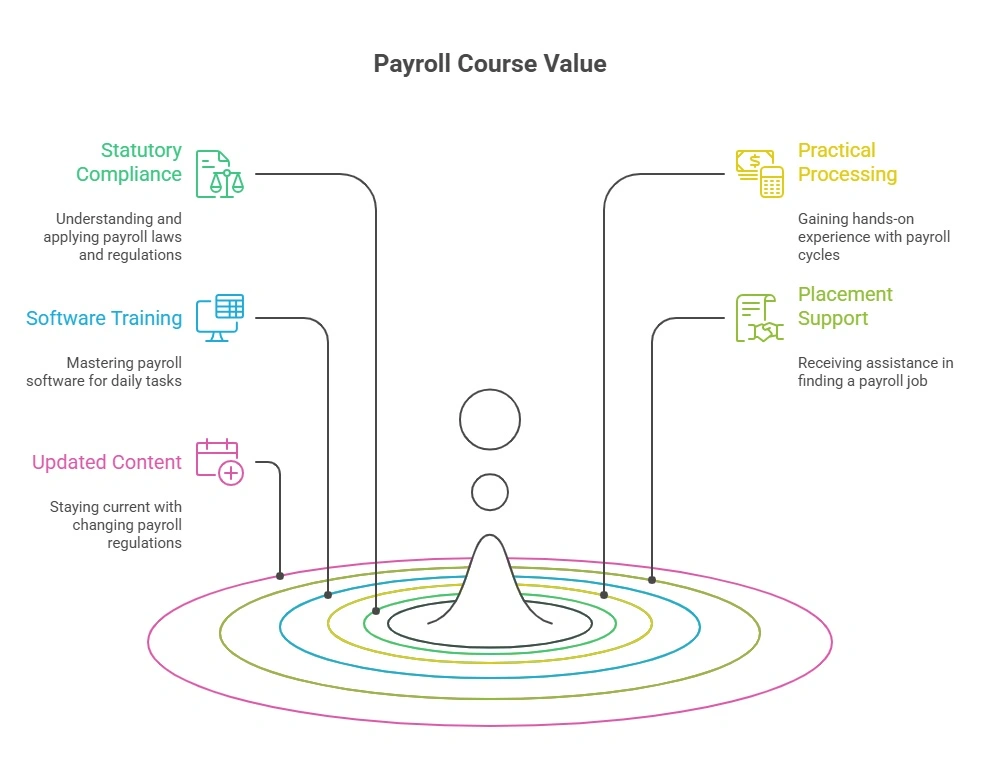

What Is Worth Paying For in a Payroll Course In India?

Not every expensive feature adds career value. Certain elements genuinely justify higher fees and have a direct impact on how confident and job-ready you feel once you step into a payroll role.

End-to-End Statutory Compliance Coverage

A strong payroll course should clearly explain Provident Fund, ESI, Professional Tax, Labour Welfare Fund, Income Tax calculations, Form 16, Form 24Q, bonus rules, and full-and-final settlements. This coverage helps learners understand not just calculations, but why deductions exist and how to answer employee or auditor questions without confusion.

Real Payroll Processing Practice

Courses that walk learners through complete payroll cycles build practical confidence. This includes monthly salary processing, arrears adjustments, leave encashment, reversals, and basic audit corrections. Practising these scenarios reduces errors during the first few months on the job.

Software Training with Real Data

Hands-on training using actual payroll software and sample salary data prepares learners for day-to-day tasks. Entering employee details, configuring statutory limits, and generating payslips in tools like Tally or Zoho Payroll mirrors real workplace expectations.

Placement Support with Verifiable Outcomes

Placement support adds value when it goes beyond generic job alerts. Interview scheduling, recruiter follow-ups, and guidance during offer discussions can shorten job search timelines. For freshers and career switchers, this support often justifies paying a higher course fee.

Updated Compliance Content

Payroll regulations in India change regularly. Courses that refresh content around wage codes, PF thresholds, tax slabs, and reporting formats help learners stay relevant. Updated material reduces the risk of applying outdated rules at work.

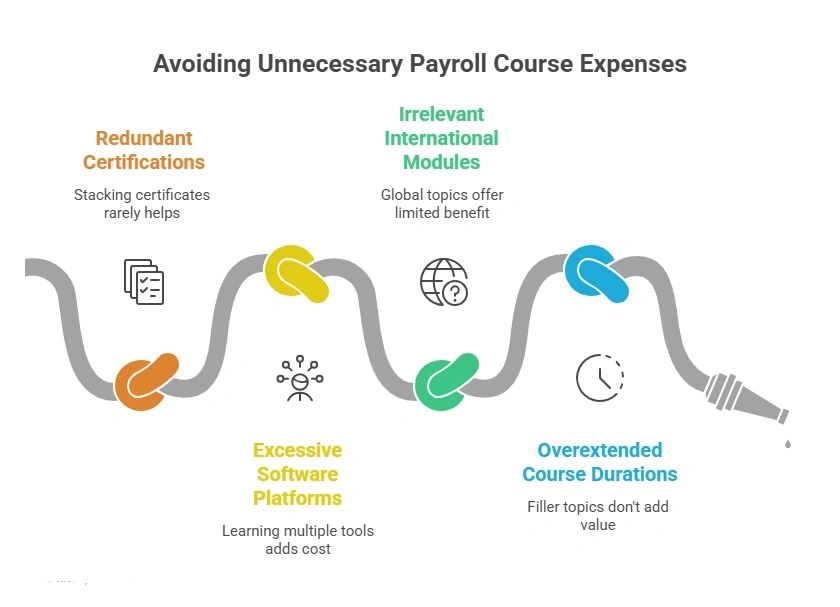

What Is Not Worth Paying Extra For In An Indian Payroll Course?

Some add-ons increase fees without improving job readiness.

Multiple Certifications for the Same Skill

One recognised payroll certification is usually enough. Stacking several certificates rarely improves hiring chances.

Extra Software Platforms

Learning three payroll tools at once adds cost and confusion. Mastery of one system transfers easily to others.

International Payroll Modules for India-Focused Roles

Global payroll topics raise fees but offer limited benefit unless you plan to handle overseas payroll.

Overextended Course Durations

A six-month course that repeats a three-month curriculum with filler topics doesn’t offer extra value. Depth matters more than length.

Low-Cost vs Mid-Range vs Premium Payroll Courses

| Aspect | Low-Cost | Mid-Range | Premium |

| Fee Range | ₹2,000–₹6,000 | ₹8,000–₹15,000 | ₹18,000+ |

| Trainer Access | Limited | Moderate | High |

| Software Practice | Minimal | Structured | Extensive |

| Placement Help | None | Partial | Strong |

| Best For | Exploration | Career entry | Fast job outcomes |

Low-cost programs work for learners testing the field. Mid-range courses balance affordability and career readiness. Premium courses suit learners who need quick employment or are changing careers.

Does Higher Payroll Course Fees In India Mean Better Salary?

Research on skill training ROI, including findings from the Sattva–JPMorgan–NASSCOM Foundation study, shows weak correlation between course cost and salary outcomes. Certified payroll professionals earn around 15–20% more than non-certified peers, regardless of whether the certification cost ₹8,000 or ₹25,000.

What influences salary growth more than fees:

- Quality of hands-on training

- Placement effectiveness

- Trainer industry connections

- Learner engagement

A ₹10,000 course with strong placement can outperform a ₹30,000 program with weak employer ties.

Who Should Invest More in a Payroll Course?

Fresh Graduates and Career Switchers

Learners without HR or accounting backgrounds benefit from structured programs with placement support. Spending more here often reduces job search time.

Working HR Professionals

Mid-range courses work well for professionals adding payroll responsibility to existing roles.

Small Business Owners

Short payroll courses covering compliance basics and software usage are usually sufficient. Premium certifications are rarely needed.

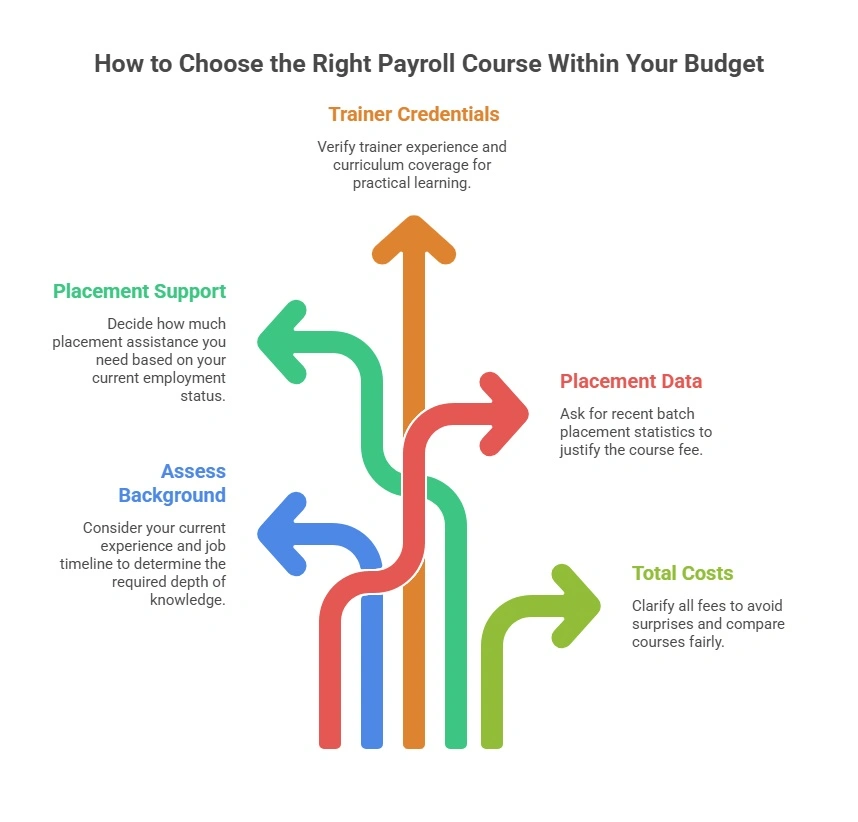

How to Choose the Right Payroll Course Within Your Budget

Assess Your Background And Job Timeline

Be clear about where you stand today. Freshers, career switchers, and experienced HR professionals need different depth levels. Your job timeline matters too—if you need a role quickly, placement-backed courses carry more value.

Decide How Much Placement Support You Need

If you already have an HR or accounts role, placement support may not be critical. Freshers and career switchers usually benefit more from interview scheduling, recruiter connections, and post-course follow-ups.

Check Trainer Credentials And Curriculum Coverage

Look for trainers with real corporate payroll experience and a curriculum that covers statutory compliance end to end. This ensures you’re learning how payroll works in practice, not just in theory.

Ask For Placement Data From Recent Batches

Instead of broad claims, ask for actual placement percentages, timelines, and hiring companies from recent batches. This helps you judge whether the fee asked is justified.

Clarify Total Costs Before Enrolling

Confirm whether certification fees, software access, study material, or assessments are included. Knowing the full cost upfront helps you avoid surprises and compare courses fairly.

SkillDeck, publishes detailed program structures that help with comparison.

Frequently Asked Questions (FAQs)

1. What is the average payroll course fee in India?

Payroll course fees in India usually range from ₹3,000 to ₹35,000. One-month courses cost ₹3,000–₹8,000, three-month programs fall between ₹12,000–₹25,000, and six-month job-oriented courses range from ₹18,000–₹35,000, depending on depth and placement support.

2. Are low-cost payroll courses worth enrolling in?

Low-cost payroll courses priced between ₹2,000–₹6,000 are suitable for beginners exploring payroll basics or professionals seeking software-specific skills. They work best for self-driven learners and usually do not include placement support or advanced compliance coverage.

3. Does paying higher payroll course fees guarantee a better salary?

Higher payroll course fees do not guarantee higher salaries. Research shows certified payroll professionals earn 15–20% more on average, but outcomes depend more on practical training, placement support, and trainer experience than on course price alone.

4. Which payroll course duration offers the best value for money?

Three-month payroll courses often offer the best balance between cost and learning depth. They provide structured statutory coverage, hands-on software training, and some placement assistance without the higher fees of extended six-month programs.

5. Is placement support worth paying extra for in a payroll course?

Yes, placement support often justifies higher fees, especially for freshers and career switchers. Courses with active interview scheduling and recruiter connections can reduce job search time by several months, offering faster return on investment.

6. Do payroll certifications really matter for jobs in India?

Recognised payroll certifications such as CPP India or institute-backed credentials improve employability. Employers value certification as proof of compliance knowledge, though one strong certification is usually sufficient rather than multiple credentials.

7. Which payroll course fee range is ideal for working HR professionals?

Working HR professionals usually benefit most from mid-range payroll courses priced between ₹8,000–₹15,000. These programs focus on compliance, payroll processing, and software skills without heavy placement components that may not be necessary.

Final Takeaway

The right online payroll course isn’t defined by price alone. What matters is whether the course prepares you for real payroll work and helps you move closer to employment or growth. A focused ₹8,000–₹12,000 course with strong practical exposure often delivers better outcomes than a costly program filled with extras.

If you’re planning a payroll career in India, match the fee to your career stage, not to marketing claims. That decision shapes both your confidence at work and your long-term returns.