Payroll often looks simple from the outside—process salaries, deduct taxes, release payslips. The reality inside organizations is very different. Payroll sits at the intersection of labour laws, taxation, accounting, audits, and employee trust. One error can trigger statutory penalties, employee dissatisfaction, or audit observations.

After working closely with payroll teams across IT, manufacturing, BFSI, startups, and service organizations, one pattern shows up repeatedly: the payroll course duration directly affects how confident and job-ready a professional becomes. A short course can create awareness. A structured, longer program builds capability.

This guide breaks down 1-month, 3-month, and 6-month payroll courses, explains what each duration truly prepares you for, and helps you choose the right option based on career stage, background, and expectations.

Why Payroll Course Duration Matters More Than You Think

Payroll is not a topic that can be understood only through concepts. It requires repetition, cycle-based learning, and exposure to real scenarios. Month-end processing, quarterly TDS returns, PF and ESI filings, annual reconciliations, and audits happen at different times. Course duration decides whether a learner only hears about these stages or actually works through them.

Having evaluated payroll capabilities across multiple organizations and trained professionals over the years, I’ve consistently observed that payroll course duration has a direct impact on real-world readiness.

Participants from 1-month payroll courses usually gain a high-level understanding of payroll processing and statutory basics. These programs suit experienced HR or finance professionals who already understand organizational workflows.

3-month payroll courses give learners enough time to work through full payroll cycles, understand PF, ESI, and TDS calculations in depth, and gain exposure to payroll software used in Indian organizations.

Professionals completing 6-month payroll programs show the strongest job readiness. They can handle compliance audits, multi-location payroll, exception cases, and statutory reconciliations with minimal supervision.

This difference is not academic. It directly affects employability, confidence, and long-term career growth in payroll.

Overview of Payroll Courses in India

Payroll courses in India vary widely in structure, depth, and outcome. Some focus only on salary calculations, others extend into labour law compliance, accounting integration, and audit preparation.

Most programs fall into three broad duration buckets:

- Short-term payroll certification (1 month)

- Medium-term payroll course (3 months)

- Advanced payroll program (6 months)

The duration often reflects how much practical exposure, case work, and statutory coverage a learner receives.

1-Month Payroll Course: What You Really Learn

Who Usually Chooses a 1-Month Payroll Course

A 1-month payroll course usually attracts:

- Experienced HR professionals moving into payroll oversight roles

- Accountants handling payroll alongside other finance tasks

- Business owners wanting basic payroll awareness

- Professionals seeking quick upskilling rather than role change

Curriculum Coverage in a 1-Month Payroll Course

Most 1-month programs focus on:

- Payroll process flow

- Salary structure components

- PF, ESI, Professional Tax basics

- TDS overview

- Payslip components

- Compliance timelines at a glance

The learning stays at a conceptual and calculation-demo level. Learners understand what needs to be done, not how it unfolds across months.

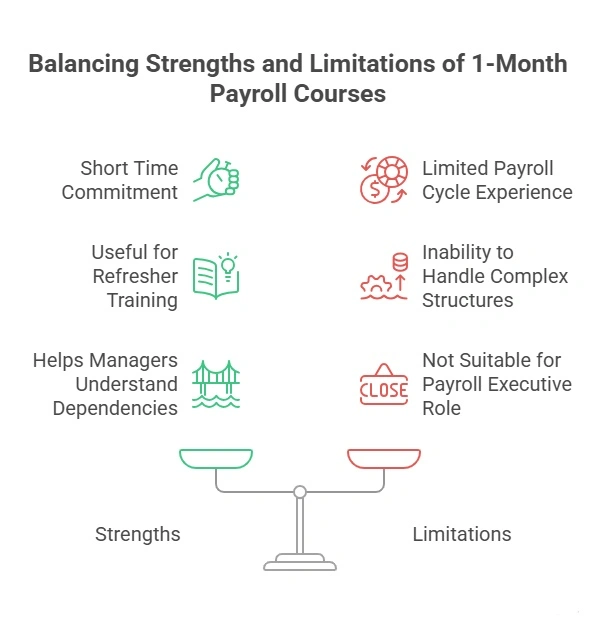

Strengths of a 1-Month Payroll Course

- Short time commitment

- Useful for refresher training

- Helps managers understand payroll dependencies

- Suitable for professionals with prior exposure

Limitations You Should Be Aware Of

A 1-month course does not allow learners to:

- Run complete payroll cycles independently

- Handle complex salary structures

- Manage arrears, reversals, or full-and-final settlements confidently

- Prepare statutory returns end-to-end

From an employer’s view, this duration rarely qualifies a fresher for a payroll executive role.

Ideal Outcome After Completion

After a 1-month payroll course, learners typically support payroll teams or coordinate with vendors rather than owning payroll processing.

3-Month Payroll Course: The Practical Middle Ground

Who Benefits Most from a 3-Month Payroll Course

This duration suits:

- HR freshers aiming for payroll roles

- Finance graduates entering HR operations

- Career switchers targeting payroll jobs

- HR generalists moving into payroll specialization

What Changes in Learning Depth

A 3-month payroll course introduces time as a learning advantage. Learners can:

- Process multiple payroll cycles

- Practice PF, ESI, and TDS calculations repeatedly

- Understand statutory thresholds and exceptions

- Work on payroll software or simulations

Typical Topics Covered

- Salary structuring and CTC breakups

- Monthly payroll processing

- PF, ESI, PT calculations with examples

- Income tax computation for salaried employees

- Payroll accounting entries

- Statutory return formats

Many structured programs align learning with statutory references such as the Employees’ Provident Fund Organisation (EPFO) guidelines and Income Tax Department of India resources, helping learners connect theory with official rules.

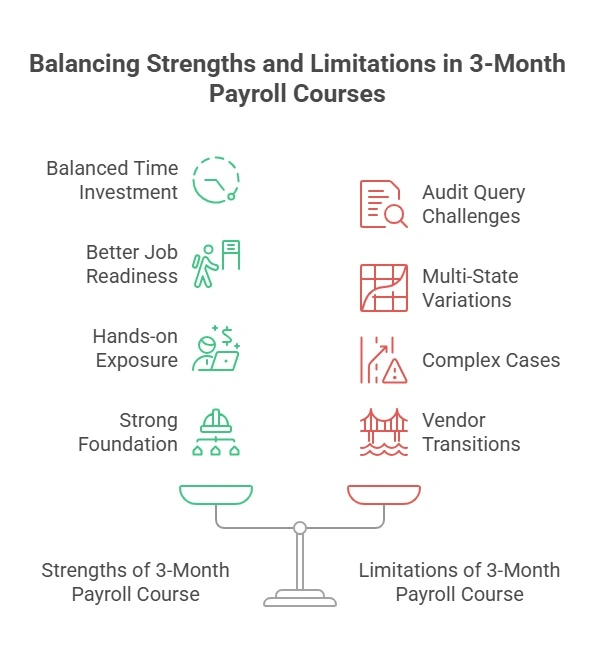

Strengths of a 3-Month Payroll Course

- Balanced time investment

- Better job-readiness than short courses

- Hands-on exposure to payroll tools

- Strong foundation for entry-level payroll roles

Where It Still Falls Short

Even with 3 months, learners may struggle with:

- Audit queries

- Multi-state payroll variations

- Complex arrears or litigation-linked cases

- Payroll transitions between vendors

Typical Career Outcome

Most learners from 3-month programs qualify for junior payroll executive or HR operations roles, especially when supported by internships or placement assistance.

6-Month Payroll Course: Built for Job Readiness

Who Should Choose a 6-Month Payroll Program

This option works best for:

- Fresh graduates targeting payroll as a primary career

- Professionals planning a full switch into payroll

- HR executives aiming for payroll leadership roles

- Individuals seeking long-term growth in compliance-heavy roles

What Makes 6 Months Different

Six months allows learners to experience payroll as it operates in real organizations. They see payroll not as a monthly task but as a year-round function.

Learners work through:

- Multiple payroll cycles

- Quarterly and annual compliance timelines

- Revisions, arrears, and settlements

- Payroll audits and reconciliations

Advanced Coverage Areas

- Labour law interpretation

- Payroll for multi-location and multi-state operations

- Full-and-final settlements

- Statutory reconciliations

- Vendor payroll coordination

- Audit preparation and responses

Programs often reference practical compliance frameworks aligned with resources from EPFO, ESIC, and payroll best practices followed by large employers.

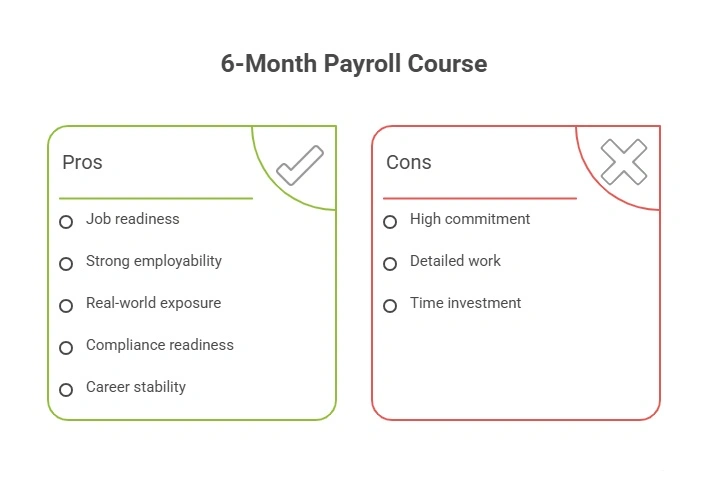

Strengths of a 6-Month Payroll Course

- High confidence handling payroll independently

- Strong employability across industries

- Exposure to real payroll challenges

- Readiness for compliance-heavy roles

Commitment Required

The longer duration needs consistency, practice, and willingness to handle detailed statutory work. The payoff reflects directly in career stability.

Career Outcomes Observed

Professionals completing 6-month programs often move into:

- Payroll executive roles

- Compliance analyst positions

- HR operations roles with payroll ownership

- Payroll lead roles within a few years

Comparison Table: 1 Month vs 3 Months vs 6 Months Payroll Courses

| Factor | 1 Month | 3 Months | 6 Months |

| Learning Depth | Basic awareness | Operational clarity | End-to-end mastery |

| Practical Exposure | Limited | Moderate | Extensive |

| Software Practice | Minimal | Included | Advanced |

| Compliance Handling | Overview | Monthly filings | Audits & reconciliations |

| Job Readiness | Low for freshers | Entry-level roles | High across roles |

| Best For | Experienced professionals | Freshers & switchers | Career-focused learners |

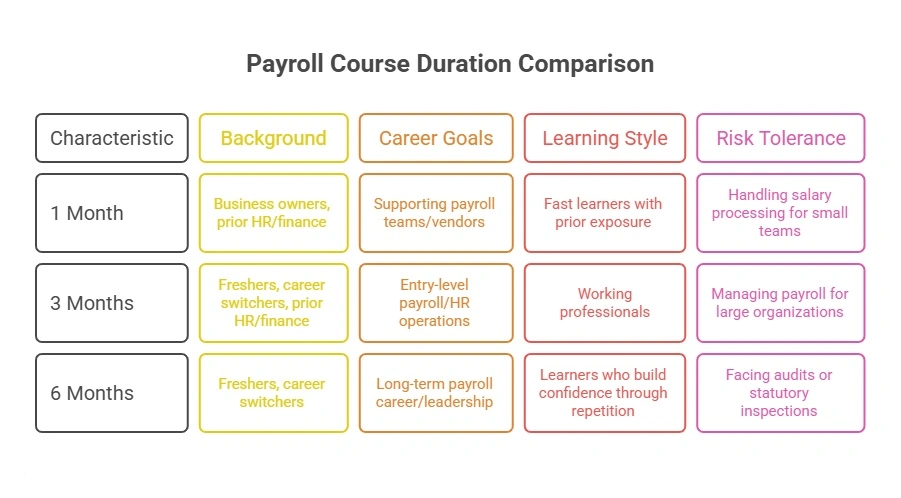

How to Choose the Right Payroll Course Duration

Choosing a payroll course is less about picking the longest program and more about matching the duration with your current skill level, career intent, and learning capacity. Payroll work exposes gaps very quickly once you enter a live environment, so the decision should be practical rather than aspirational.

Based on Your Background

Your existing exposure to HR, finance, or compliance plays a major role in how much time you actually need.

- Prior HR or finance experience (1 or 3 months):

Professionals who already understand organizational processes, employee lifecycle, or accounting logic usually adapt faster. For them, a 1-month course works as a structured orientation, helping connect existing knowledge to payroll compliance. A 3-month course adds depth, allowing them to move from coordination to execution. - Freshers or career switchers (3 or 6 months):

Learners without workplace exposure need time to understand how payroll decisions affect employees, auditors, and management. A 3-month program builds entry-level capability. A 6-month program adds maturity through repetition and scenario handling, which reduces early-career mistakes. - Business owners or founders (1 month):

Owners benefit from understanding payroll logic, compliance timelines, and risk areas. They do not usually need execution-level depth, making short courses sufficient for oversight and vendor management.

Based on Career Goals

Your target role should guide duration selection more than convenience.

- Supporting payroll teams or vendors:

If your role involves coordination, approvals, or data sharing, a 1-month course provides enough clarity to communicate confidently without owning outcomes. - Entry-level payroll or HR operations roles:

A 3-month course prepares you to process payroll independently for small or mid-sized organizations. Employers expect operational comfort at this level. - Long-term payroll career or leadership path:

A 6-month program builds readiness for complex environments. Professionals aiming for payroll lead, compliance analyst, or audit-facing roles benefit from longer exposure early in their career.

Based on Learning Style and Time Availability

Duration should match how you absorb information and practice skills.

- Fast learners with prior exposure:

Shorter programs work well when learners already understand systems and only need payroll-specific clarity. - Learners who build confidence through repetition:

Longer programs help reinforce calculations, statutory logic, and exception handling. Payroll accuracy improves with repeated practice rather than one-time understanding. - Working professionals:

A 3-month course with weekend or evening formats often balances learning depth with job responsibilities better than compressed short programs.

Based on Risk Tolerance and Responsibility Level

Payroll errors have direct consequences. The more responsibility you plan to carry, the more preparation time you need.

- Handling salary processing for small teams allows limited margin for error.

- Managing payroll for large or multi-location organizations demands strong compliance control.

- Facing audits or statutory inspections requires confidence built through extended exposure.

Choosing the right duration is about reducing risk—both for yourself and for the organization trusting you with payroll ownership.

Common Myths About Payroll Course Duration

Misunderstandings around payroll course duration often lead learners to choose programs that do not match their actual career needs. These myths usually come from marketing claims or incomplete information shared online. Clarifying them helps set realistic expectations.

“Short Courses Are Enough for Jobs”

Short payroll courses introduce concepts and terminology, which helps learners speak the language of payroll. What they rarely provide is execution confidence. Employers hiring for payroll roles expect candidates to process salaries accurately, handle statutory timelines, and respond to employee queries without constant supervision. A short course supports awareness, not accountability. Candidates relying only on brief training often need extended on-the-job correction.

“Long Courses Are Only Theory”

This belief comes from poorly structured programs, not from duration itself. Well-designed 6-month payroll courses rely heavily on practice. Learners spend more time processing data, reconciling figures, and handling scenarios than listening to lectures. The extended duration allows mistakes to surface during training rather than on the job, which employers value.

“Software Training Alone Is Sufficient”

Payroll software automates calculations but does not replace statutory understanding. When software throws validation errors, flags compliance issues, or requires configuration changes, only conceptual clarity helps resolve them. Professionals trained only on software steps struggle when rules change or exceptions arise. Strong payroll professionals understand the logic behind the system, not just the clicks.

“Course Duration Directly Decides Salary”

Duration influences starting roles, not fixed pay. Salary depends on responsibility level, organization size, location, and experience. A professional from a 3-month program working independently may earn more than a 6-month graduate in a support role. Duration improves readiness, but performance and ownership determine growth.

“One Payroll Course Is Enough for an Entire Career”

Payroll regulations change every year through budget updates, notifications, and circulars. No course, regardless of length, keeps a professional current forever. Course duration builds foundation. Career longevity depends on continuous updates, refresher training, and hands-on experience.

Understanding these myths helps learners choose payroll training with clarity rather than assumptions.

Conclusion: Picking the Duration That Works for You

Payroll rewards accuracy, patience, and compliance knowledge. Course duration decides how prepared you feel when real responsibility arrives.

A 1-month course creates awareness. A 3-month course builds working confidence. A 6-month course prepares you for ownership.

If payroll is part of your role, a shorter payroll program help. If payroll is your career, time invested in deeper training pays back through stability, growth, and trust from employers.

For readers planning the next step, reviewing detailed payroll syllabi, compliance references from EPFO and the Income Tax Department, and structured training programs can help you choose a path that fits both present needs and future plans.

Frequently Asked Questions (FAQs) on Payroll Course Duration

1. Is a 1-month payroll course enough to get a payroll job?

A 1-month payroll course builds basic awareness of payroll processes and statutory components. It rarely prepares freshers for independent payroll roles. Employers usually expect longer training or prior experience for execution-level payroll positions.

2. Do companies in India prefer 3-month or 6-month payroll courses?

Most companies hiring entry-level payroll professionals prefer candidates with at least a 3-month payroll course. For roles involving compliance ownership, audits, or multi-location payroll, candidates from 6-month programs are often preferred.

3. How many payroll cycles are covered in a 3-month payroll course?

A structured 3-month payroll course usually covers two to three complete payroll cycles. This includes monthly processing, statutory deductions, and return preparation, helping learners understand repetition and timelines.

4. What additional skills do learners gain in a 6-month payroll course?

Six-month payroll courses cover audits, reconciliations, multi-state compliance, full-and-final settlements, and exception handling. Learners gain confidence in managing payroll independently with minimal supervision.

5. Can experienced HR professionals benefit from a short payroll course?

Yes. Experienced HR professionals often use 1-month payroll courses to understand compliance logic, payroll calculations, and coordination points. Their existing workplace exposure compensates for the shorter training duration.

6. Does payroll software training reduce the need for longer courses?

Payroll software helps with automation, but statutory understanding remains essential. Longer courses provide clarity on rules, thresholds, and exceptions that software alone cannot explain.

7. Is a longer payroll course worth the extra time investment?

For learners planning a long-term payroll career, longer courses reduce early job errors and improve confidence. The additional time often translates into better job readiness and smoother career growth.