Payroll is one of those functions that everyone depends on, yet very few truly understand how it works until something goes wrong. Late salaries, incorrect deductions, or unclear payslips immediately affect employee trust and business credibility. That is why payroll cannot be treated as a background task or learned informally.

When I began working in HR operations, I quickly realised that payroll is not something you can pick up casually. Salary structures, PF–ESI rules, income tax calculations, and payroll software follow strict logic and legal rules. One small mistake can lead to employee dissatisfaction, compliance notices, or financial penalties. A payroll course gave me structured clarity on how payroll actually works in real organisations, not just in theory.

As workplaces become more regulated and technology-driven, payroll knowledge has moved beyond a niche skill. By 2026, it has become a core requirement across HR, finance, accounting, and even small business management. Employers expect payroll professionals to understand compliance, systems, reporting, and employee queries with confidence.

This blog explains what a payroll course really is, what people learn in it, how payroll has changed in 2026, and who should seriously think about enrolling.

What Is Payroll Course?

A payroll course is a professional training programme that teaches how employee salaries are calculated, processed, recorded, and reported in line with statutory laws. It focuses on the complete payroll cycle, from salary structure design to monthly processing and statutory filings.

Payroll courses are available in multiple formats:

- Online self-paced programmes

- Instructor-led virtual classes

- Classroom training

- Hybrid formats

Many recognised payroll programmes follow structured curricula similar to those offered by Skilldeck.

A good payroll course connects statutory concepts with actual payroll processing, ensuring learners know not just what the rules are, but how to apply them in real systems.

What People Learn in a Payroll Course

Payroll courses are structured to move from basics to practical execution. Below is a clear breakdown of what learners typically gain.

Payroll Fundamentals and Salary Structure

Participants learn how salaries are designed and broken down. This includes:

- Gross salary and CTC structure

- Fixed vs variable pay

- Allowances and reimbursements

- Overtime and leave encashment

A well put-together payroll courses show how structured salary components impact tax and statutory deductions.

Statutory Compliance and Labour Laws

Compliance forms the backbone of payroll. A payroll course covers:

- Provident Fund (PF)

- Employee State Insurance (ESI)

- Professional Tax

- Income Tax (TDS on salary)

- Labour welfare fund and gratuity

Indian-focused programmes explain how these laws apply in day-to-day payroll processing.

Payroll Processing Cycle

Learners understand the end-to-end payroll workflow:

- Attendance and leave data inputs

- Monthly payroll calculations

- Payslip generation

- Salary disbursement

- Payroll reconciliation

This practical cycle is explained clearly in guides such as the Henry Harvin payroll overview.

Payroll Software and Tools

Modern payroll work relies heavily on software. Most payroll courses provide exposure to tools such as:

- Tally Payroll

- ADP

- Workday

- GreytHR

- Cloud-based payroll platforms

For example, Tally Education’s payroll programme focuses on payroll processing inside accounting systems.

Payroll Reporting and Audits

Payroll professionals generate multiple reports for HR, finance, and statutory authorities:

- Salary registers

- PF and ESI returns

- Tax reports

- Payroll cost summaries

Courses also teach internal payroll checks and audits to avoid mismatches and penalties.

Employee Queries and Payroll Communication

Handling employee questions is part of daily payroll work. Learners gain clarity on:

- Payslip explanations

- Tax-saving declarations

- Full and final settlement

- Error resolution

This practical exposure reduces dependency on trial-and-error learning.

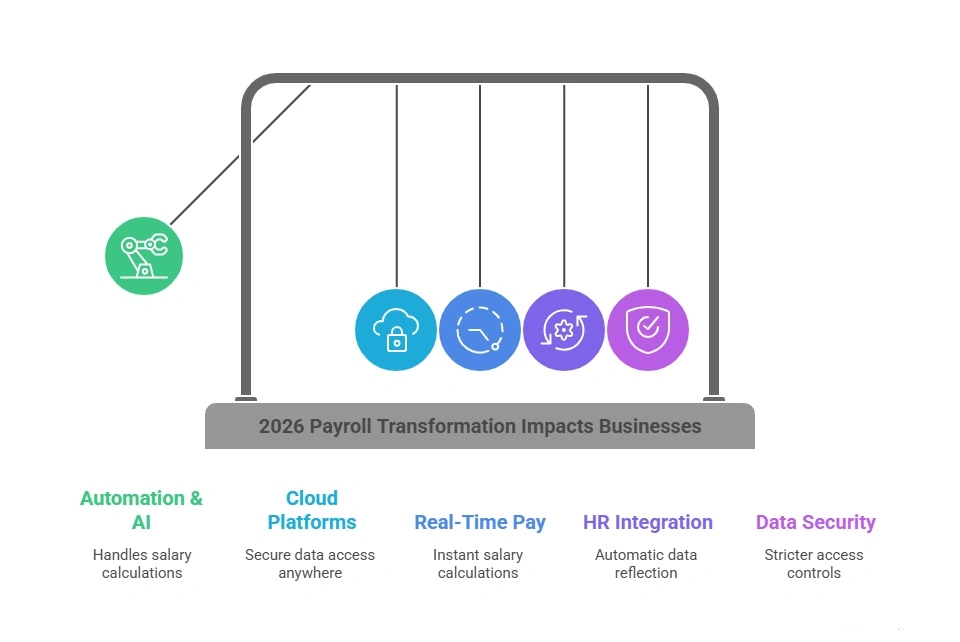

How Payroll Has Changed in 2026

Payroll in 2026 looks very different from manual Excel-based processing of the past. It has shifted into a system-driven, compliance-focused function where accuracy, speed, and transparency matter at every step.

Automation and AI-Based Processing

AI-driven systems now handle salary calculations, validation checks, and error detection with minimal manual effort. These systems flag inconsistencies in attendance data, deductions, or tax calculations before payroll is finalised. According to Ramco’s global payroll trends, automation has reduced payroll errors and shortened processing cycles, allowing payroll teams to focus more on reviews and exception handling rather than repetitive tasks.

Cloud-Based Payroll Platforms

Cloud payroll platforms allow payroll data to be accessed securely from anywhere, which supports remote approvals and distributed teams. Payroll data now flows directly between attendance systems, HRMS, and finance tools, reducing duplicate entries. This shift towards cloud-based payroll is discussed in reports such as Workforce.com’s payroll trends, which highlight better visibility and faster processing as key benefits.

Real-Time and On-Demand Pay

Real-time payroll capabilities allow organisations to calculate salary components instantly when attendance or incentives change. Earned wage access and flexible pay cycles are becoming more common, especially in high-volume workforces. Tools that support instant salary computation help reduce payroll disputes and improve employee confidence, as outlined in SmartHR’s automation guide.

Integration with HR and Finance Systems

Payroll systems now connect directly with HRMS and ERP platforms, which reduces manual reconciliation between departments. Changes in employee data such as promotions, exits, or salary revisions reflect automatically in payroll calculations. Deloitte’s insights on payroll transformation explain how this integration improves accuracy, audit readiness, and compliance consistency (Deloitte payroll transition report).

Data Security and Compliance

Payroll data contains sensitive personal and financial information, making security a priority. Organisations now follow stricter access controls, audit trails, and data protection practices. As a result, payroll courses include confidentiality handling, system permissions, and compliance awareness to prepare professionals for handling payroll data responsibly.

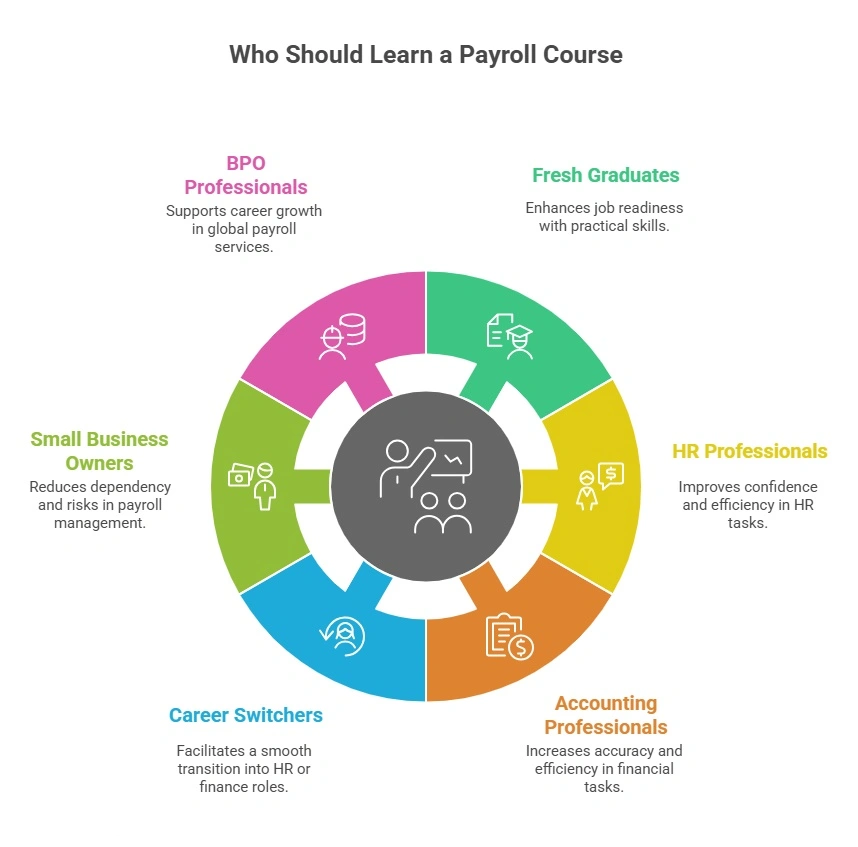

Who Should Learn a Payroll Course in 2026?

Payroll courses are no longer limited to payroll clerks alone. In 2026, payroll knowledge supports several career paths and professional needs across HR, finance, operations, and business ownership.

Fresh Graduates and Entry-Level Job Seekers

Graduates from commerce, management, HR, or accounting backgrounds often understand theory but lack exposure to real workplace processes. A payroll course fills this gap by teaching how salaries are actually processed inside organisations. It improves job readiness for roles in HR operations, payroll support, and finance teams, especially where employers expect hands-on skills from day one.

HR Professionals and Generalists

HR executives and generalists regularly deal with salary queries, onboarding, exits, and compliance coordination. Without payroll clarity, these tasks become dependent on others. Learning payroll allows HR professionals to handle compensation discussions confidently, reduce errors during employee lifecycle events, and work more smoothly with finance teams. This is why many HR professionals upskill through payroll, as explained in ADP’s payroll training guide.

Accounting and Finance Professionals

Accountants and finance professionals handle salary expenses, statutory filings, audits, and reconciliations. Payroll knowledge helps them understand how salary structures affect taxation, provisions, and financial reporting. A payroll course bridges the gap between accounting entries and employee-level salary data, making audits and compliance work more accurate and efficient.

Career Switchers

Professionals from administration, operations, customer support, or compliance roles often move into payroll due to its stable demand and structured work. A payroll course offers a clear learning path, reducing dependency on trial-and-error and shortening the transition period into HR or finance support roles.

Small Business Owners and Founders

Many small business owners manage payroll themselves or supervise vendors. Learning payroll helps them understand statutory obligations, salary structuring, and monthly cost control. This reduces dependency on external agencies and lowers the risk of penalties or employee disputes.

BPO and Shared Services Professionals

Payroll outsourcing firms and global capability centres handle large employee volumes across regions. These roles require professionals who understand payroll rules, timelines, and system-driven processing. Payroll certifications recognised across geographies support faster career growth in shared services and outsourcing environments.

Jobs Available After Completing a Payroll Course

Payroll courses open multiple job options across industries.

| Job Role | Typical Experience Level | Salary Range (India) |

| Payroll Executive | Entry-level | ₹2.5 – ₹4.5 LPA |

| Payroll Administrator | 2–4 years | ₹3 – ₹7 LPA |

| Payroll Specialist | 3–6 years | ₹5 – ₹12 LPA |

| Payroll Manager | 6+ years | ₹10 – ₹18 LPA |

Demand data from LinkedIn payroll jobs in India shows steady hiring across metro cities.

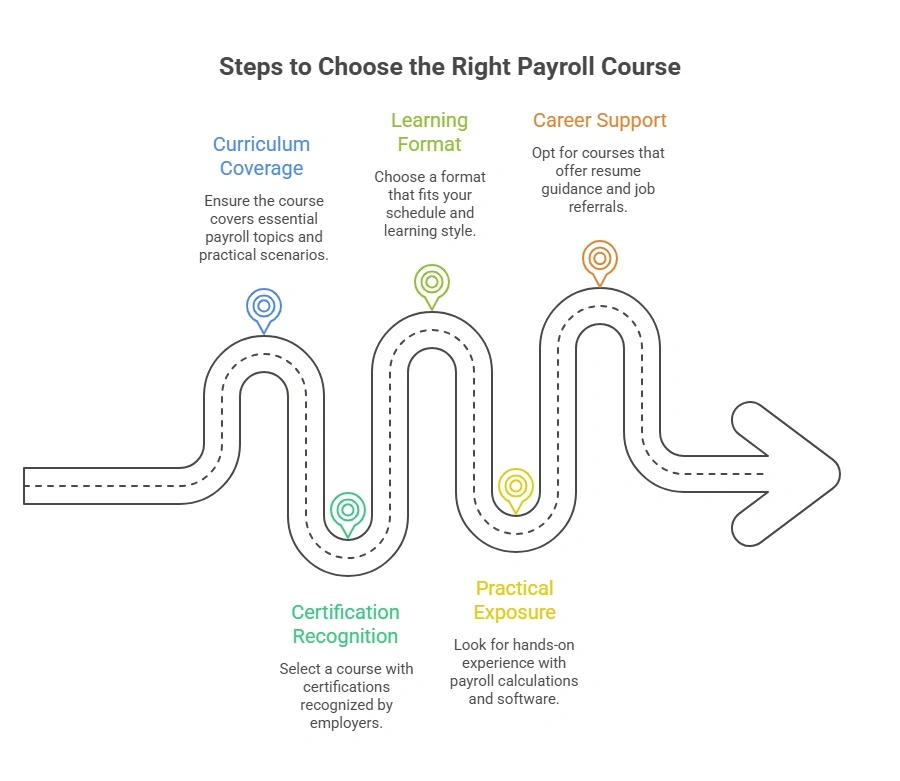

How to Choose the Right Payroll Course

Selecting the right programme matters as much as learning payroll itself. A well-chosen course saves time, improves job readiness, and reduces confusion during real payroll handling.

Curriculum Coverage

Start by reviewing the syllabus in detail. A reliable payroll course should cover Indian payroll laws, monthly processing steps, statutory filings, and year-end activities. Practical payroll processing and real salary scenarios matter more than theory-heavy modules. Courses that include case-based learning help learners understand how payroll decisions play out in real organisations.

Certification Recognition

Certification value depends on employer recognition. Courses linked to known institutions or industry-recognised certifications carry more credibility during hiring. Recognised certifications signal that the learner understands standard payroll practices and compliance requirements, which reduces employer training effort.

Learning Format

Learning format should match work schedules and learning preferences. Online courses suit working professionals who need flexible timing. Classroom formats work well for learners who prefer structured schedules and direct instructor interaction. Hybrid models combine flexibility with guided sessions.

Practical Exposure

Payroll skills develop through practice. Courses that include real payroll calculations, software demonstrations, and sample payslip processing prepare learners for actual job responsibilities. Hands-on exposure reduces dependency on on-the-job guesswork and builds confidence during interviews and initial payroll assignments.

Placement and Career Support

Career support adds value, especially for freshers and career switchers. Resume guidance, interview preparation, and job referrals help shorten the transition into payroll roles. While placement is never guaranteed, structured career assistance improves visibility and readiness for payroll openings.

Is a Payroll Course Worth It in 2026?

Payroll courses continue to show strong returns on the time, effort, and cost invested, especially as payroll responsibilities expand beyond basic salary processing.

Career Stability

Payroll roles remain necessary across industries, irrespective of hiring cycles or market slowdowns. Every organisation must pay employees accurately and on time, which keeps payroll functions active even during restructuring or cost-control phases. This makes payroll a relatively stable career option compared to many other operational roles.

Salary Growth

Certified payroll professionals tend to earn more than peers who learn payroll informally on the job. Certification signals structured knowledge of compliance, systems, and reporting, which employers value when assigning responsibility-heavy roles. As explained in VerifyEd’s CPP guide, recognised credentials often support faster salary progression and access to senior payroll roles.

Skill Longevity

Payroll skills age well when updated periodically. Core concepts such as salary structuring, statutory deductions, and compliance remain consistent, even as tools evolve. A payroll course builds a foundation that can be refreshed through short updates, rather than requiring complete reskilling every few years.

Market Demand

Organisations continue to hire trained payroll professionals to manage compliance risk, employee queries, and system-driven payroll operations. Reports such as AIHR’s payroll manager overview show steady demand for payroll specialists and managers, particularly in shared services, MNCs, and compliance-focused roles.

Conclusion: Should You Enrol in a Payroll Course?

A payroll course offers structured learning for anyone dealing with salaries, compliance, or employee compensation. From my own HR experience, learning payroll through a proper course removed confusion and improved confidence when handling real employee cases.

In 2026, payroll knowledge supports stable career paths for fresh graduates, HR professionals, accountants, career switchers, and business owners. If you want predictable growth, clear responsibilities, and long-term relevance, a payroll course remains a practical choice.

If payroll features anywhere in your role today or future plans, structured learning is the safest way forward.

Frequently Asked Questions (FAQs)

1. What exactly is covered in a payroll course in 2026?

A payroll course in 2026 covers end-to-end salary processing, statutory compliance, payroll software usage, and reporting. Based on current industry curricula, learners are trained in salary structuring, PF, ESI, professional tax, income tax on salary, payroll reconciliation, and the use of cloud-based and automated payroll systems. Modern courses also introduce AI-driven payroll checks and integration with HR and finance systems.

2. Do I need an HR or accounting background to learn payroll?

No prior HR or accounting background is mandatory. Payroll courses are designed for beginners as well as professionals. The research shows that fresh graduates, career switchers, and operations professionals can start with foundational payroll programmes that explain concepts step by step, before moving into compliance and system-based processing.

3. Is a payroll course useful even when payroll software is automated?

Yes. Automation has reduced manual work, but it has increased the need for skilled professionals who understand payroll logic, compliance rules, and exception handling. Payroll courses teach how to review system outputs, validate calculations, and manage statutory accuracy, which software alone cannot fully replace.

4. What jobs can I get after completing a payroll course?

After completing a payroll course, candidates commonly move into roles such as Payroll Executive, Payroll Administrator, Payroll Specialist, or HR Payroll Coordinator. With experience, professionals can grow into payroll manager, payroll analyst, or global payroll roles, especially in shared services and outsourcing environments.

5. Is a payroll course worth it in 2026 for long-term career growth?

Research indicates that payroll skills continue to offer stable demand due to regulatory requirements and business dependence on accurate salary processing. Certified payroll professionals typically earn higher salaries than non-certified peers and experience clearer career progression, particularly as payroll becomes more system-driven and compliance-focused.

6. How do I choose the right payroll course for my career goals?

Choosing the right payroll course involves checking curriculum relevance, statutory coverage, software exposure, and certification recognition. Courses aligned with current payroll practices, real salary scenarios, and compliance updates provide better job readiness than theory-heavy programmes. Career support and practical assignments further strengthen outcomes.