Managing payroll is one of those tasks every business must get right. People expect accurate salaries, timely payments, and proper tax handling. But behind the scenes, payroll can feel like a constant cycle of deadlines, data checks, filings, and updates. That’s exactly why so many companies ask the same question:

Should we keep payroll in-house or outsource it?

Both options work – just in different ways. And importantly, the right choice depends on your company size, your compliance needs, your internal HR strength, and how much time you want to spend managing payroll.

I’ve personally handled payroll both ways. When I managed payroll in-house, I liked having full control. But it was stressful. Keeping up with new compliance rules, fixing errors at the last minute, and handling month-end rushes felt never-ending. Later, when we switched to outsourcing, most of that pressure dropped. Compliance was handled by specialists, calculations were smoother, and I didn’t spend half my week on payroll checks. Of course, we had to follow the vendor’s timelines, but overall it made everyday work lighter.

In this guide, you’ll get a clear, structured look at Payroll Outsourcing vs In-House Payroll, supported by research from reputable sources. The goal is simple: help HR professionals, business owners, and finance leaders make informed, confident decisions.

What Is In-House Payroll?

In-house payroll means your company handles everything internally that includes calculations, statutory filings, employee queries, software updates, and more. This model works well for businesses with strong HR or finance teams who can manage payroll cycles independently.

According to CIPHR’s breakdown of in-house payroll, companies often choose this model when they want full control and the ability to customize pay structures.

In-house teams commonly manage:

- Attendance and leave data

- Compensation calculations (gross, net, bonuses, deductions)

- Tax withholdings

- Statutory filings and returns

- Payslips and payment distribution

- Payroll reporting and audits

For larger companies, in-house payroll can be a strong long-term investment, especially if they have an established system of internal tools and workflows.

What Is Payroll Outsourcing?

Payroll outsourcing involves hiring an external provider to handle payroll operations. The provider uses specialized systems, updated compliance frameworks, and dedicated payroll experts.

As explained in ADP’s guide to outsourcing payroll, outsourcing often covers:

- Payroll calculations

- Tax filings

- Compliance monitoring

- Salary payments

- Employee self-service portals

- Reporting and documentation

Modern vendors like Deel and Ramco also offer add-ons such as time tracking, global payroll support, and automated tools.

Companies usually outsource payroll to lower risk, reduce admin workload, and improve accuracy especially when operating across multiple states or countries.

Key Differences Between In-House Payroll and Payroll Outsourcing

The table below summarizes the major differences between In-House Payroll and Payroll Outsourcing.

Payroll Comparison Table: In-House vs Outsourcing

| Factor | In-House Payroll | Payroll Outsourcing |

| Control | Full control over processes, cut-off times, and adjustments | Less direct control; must follow provider workflows |

| Compliance | Internal team must monitor updates | Specialists manage compliance with changing laws |

| Time Requirement | High; HR/finance must handle every step | Low; company reviews and approves only |

| Cost Structure | Staff salaries + software + training + penalties | Predictable monthly fees (base + per employee) |

| Scalability | Requires more hires as company grows | Easily scalable across multiple locations |

| Data Security | Depends on internal systems | Enterprise-grade security, backups, and encryption |

| Customization | Highly customizable for unique rules | Limited by provider capabilities |

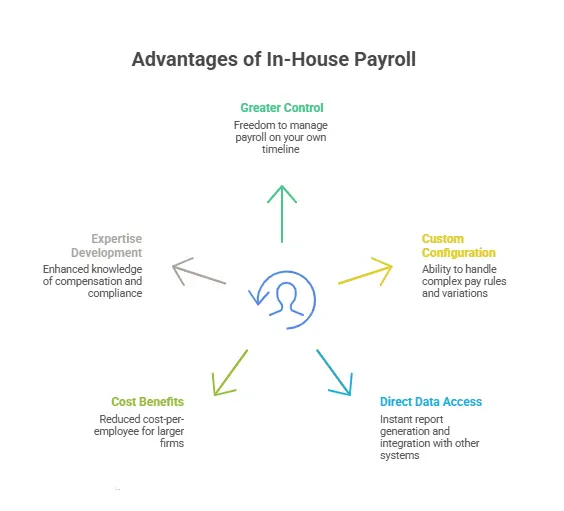

Advantages of In-House Payroll

1. Greater Control and Flexibility

In-house payroll gives you the freedom to run payroll on your timeline. Last-minute changes like incentive adjustments or corrections are easier to apply.

2. Custom Configuration

Companies with complex pay rules benefit from internal control. This includes unique deductions, location-based variations, or non-standard allowances.

3. Direct Access to Payroll Data

Teams can generate any report instantly, integrate with HRIS or accounting tools, and access detailed audit information.

4. Long-Term Cost Benefits for Larger Firms

Once systems and teams are in place, the cost-per-employee can drop significantly.

5. Internal Expertise Development

Your HR and finance teams gain deep knowledge of employee compensation patterns and compliance frameworks.

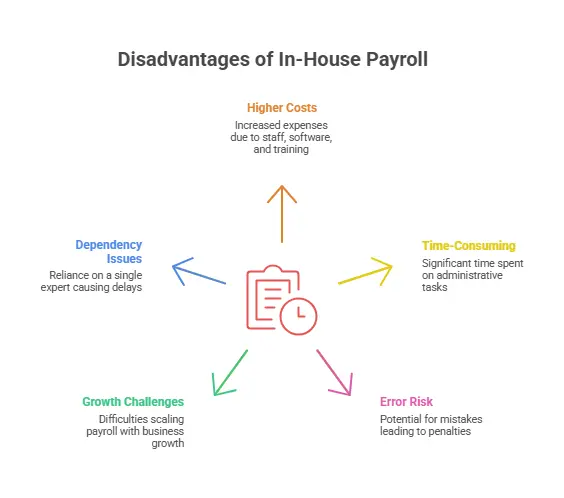

Disadvantages of In-House Payroll

1. Higher Total Cost (Especially for Smaller Businesses)

In-house payroll requires:

- Payroll staff salaries

- Software subscription or license

- Training on compliance updates

- Time spent on audits and filings

Over time, these add up.

2. Time-Heavy Administrative Work

Smaller companies often spend 5+ hours per pay cycle, sometimes more.

This was the toughest part of the job when I handled payroll internally, as checking data, re-verifying, updating tax tables, and preparing statutory files took a big chunk of my week.

3. Higher Error Risk

Tax and labor rules change often. Missing an update can directly cause penalties.

4. Bottlenecks During Growth

As your team grows, you need more payroll capacity. That may mean more hires, new tools, or additional training.

5. Key Person Dependency

Payroll may get delayed or done incorrectly If your payroll expert is unavailable.

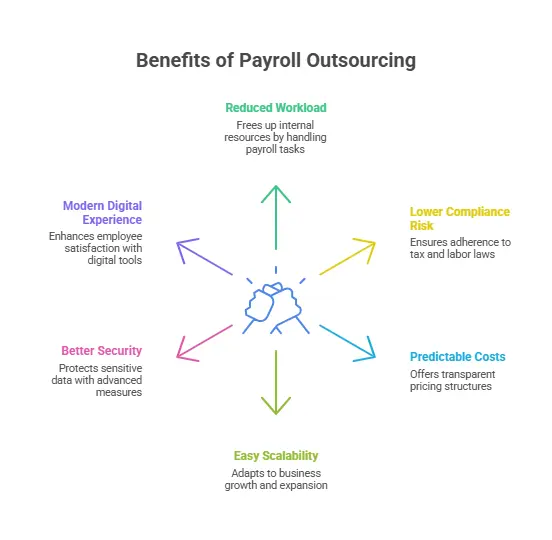

Advantages of Payroll Outsourcing

1. Reduced Workload and Time Savings

The biggest benefit I personally experienced was freedom from constant payroll deadlines. The vendor handled calculations, filings, and reports while we only reviewed outputs.

2. Lower Compliance Risk

Providers stay updated with tax and labor laws across states/countries, which reduces penalty risk.

3. Predictable and Often Lower Costs

Most vendors follow a simple pricing structure:

- Base monthly fee

- Per-employee charge

This pricing usually includes software and updates.

4. Easy Scalability

Your outsourcing adapts easily with the company’s size whether you grow from 20 employees to 200 or expand across borders.

5. Better Security

Vendors invest heavily in data encryption, access controls, and disaster recovery.

6. Modern Digital Experience

Many outsourcing solutions offer:

- Employee self-service portals

- Mobile payslip access

- Automated reporting

This improves overall employee satisfaction.

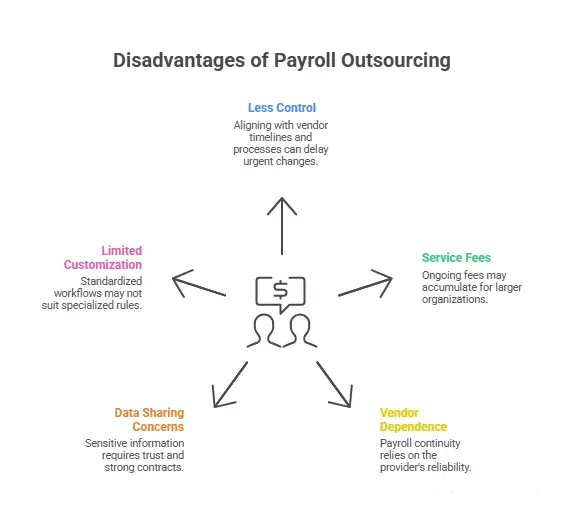

Disadvantages of Payroll Outsourcing

1. Less Control

You must align with the vendor’s timelines and processes. Urgent changes take longer to implement.

2. Service Fees

While payroll outsourcing is cheaper than in-house for small and mid-size businesses, larger organizations have to deal with ongoing fees which can add up.

3. Vendor Dependence

Payroll continuity depends on the provider’s reliability. Outages or errors affect your entire company.

4. Data Sharing Concerns

Payroll involves sensitive information. This requires trust and strong contracts with your vendors.

5. Limited Customization

Standardized workflows may not suit companies with highly specialized rules.

Cost Comparison: In-House vs Outsourcing

Here’s a research-backed breakdown using references from LiftHCM cost analysis and Zeal payroll efficiency study.

In-House Payroll Costs

| Cost Type | Description |

| Payroll Staff | Salaries for payroll officers/HR staff |

| Software | Licenses, maintenance, upgrades |

| Compliance Training | Ongoing refreshers on tax/labor rules |

| Errors & Penalties | Fines for incorrect or late filings |

| Processing Time | Opportunity cost of HR/finance hours |

Outsourced Payroll Costs

| Cost Type | Description |

| Base Fee | Monthly or per-run charge |

| Per-Employee Fee | Usually $20–150 USD per employee per month |

| Setup Fee | One-time onboarding cost |

| Optional Add-Ons | Time tracking, HR advisory, analytics |

According to multiple analyses, outsourcing is often 18% cheaper than in-house payroll for small and mid-size businesses.

When Should You Choose Payroll Outsourcing?

Based on insights from Deel, ADP, and Ramco we recommend investing in payroll outsourcing services if –

- Your HR team is overloaded

- You operate across states/countries

- Your company is growing fast

- You want predictable monthly payroll costs

- You have limited internal payroll expertise

- You have experienced errors or penalties in the past

If this describes your current situation, then outsourcing offers smoother operations and fewer risks.

You can consider SkillDeck’s Payroll Outsourcing service which provides accurate payroll processing, statutory compliance, and timely reporting. This way you can focus on scaling your business instead of chasing risks and errors of payroll management.

When Should You Keep Payroll In-House?

In-house management is usually better when:

- You’re a large organization with stable processes

- You require heavy customization

- You already have strong internal payroll expertise

- You must keep sensitive data within company systems

- You want complete control over pay cycles and cut-offs

A Practical Payroll Decision Framework

To make an informed choice between payroll Outsourcing vs In-House payroll you should –

1. Assess Your Current Internal Costs

Include salaries, software, time spent, and past penalties.

2. Compare With Vendor Quotes

Request itemized pricing.

3. Analyse Your Compliance Risk

If you’ve faced frequent rule changes or penalties, outsourcing may lower risk.

4. Consider Your Growth Plans

Scalability matters more than you think.

5. Evaluate Internal Expertise

If payroll knowledge is limited to one person, that’s a significant operational risk.

6. Explore hybrid models

Some companies keep policy decisions in-house but outsource processing and filings.

Conclusion

Choosing between payroll outsourcing and in-house payroll isn’t about which is “better.” It’s about what fits your company’s size, structure, and long-term plans.

In-house payroll offers full control, customization, and internal expertise. But it demands time, training, and constant attention.

Payroll outsourcing reduces workload, minimizes compliance risk, and provides scalability with predictable costs. For small and growing businesses, this often becomes the simpler and more reliable route.

From my own experience handling both models, I can say this: the best choice depends on how much time you can afford to spend on payroll and how confident you are in your internal compliance strength. Outsourcing can make a significant difference if payroll frequently feels stressful, heavy, or error-prone.

FAQs

1. Why Do Companies Choose To Outsource Payroll?

Companies outsource payroll to reduce administrative workload, control costs, and lower the chance of calculation and compliance errors. Payroll vendors manage tax updates, statutory filings, and reporting, which removes pressure from internal teams. This approach also supports growth without hiring additional payroll staff, making it easier for HR teams to focus on workforce planning and employee support.

2. What Are The Five Main Payroll Steps?

Payroll usually follows five steps: collecting attendance and salary inputs, calculating earnings, applying deductions and statutory contributions, processing salary payments, and submitting statutory reports. Accuracy at each step is critical. Mistakes often occur during calculations or filings, which is why many businesses rely on automation or specialist handling to maintain consistency and accuracy.

3. Can Any Business Outsource Payroll?

Most businesses can outsource payroll regardless of size. Outsourcing works well for companies with growing teams, multiple locations, or limited internal payroll expertise. Small businesses with stable headcount and simple pay structures may manage payroll internally, but outsourcing becomes more practical as employee numbers, regulations, and reporting needs increase.

4. What Is The Best Payroll System For Businesses?

The best payroll system depends on business needs. Outsourced payroll systems suit companies with complex compliance requirements or expansion plans. These systems handle updates, calculations, and reporting without internal effort. In-house systems may suit small teams with simple payroll, but they often require ongoing upgrades, training, and close monitoring to remain accurate.

5. Is Payroll Outsourcing Cheaper Than In-house Payroll?

Payroll outsourcing is usually more cost-friendly when total expenses are considered. In-house payroll involves staff salaries, software costs, training, and time spent fixing errors. Outsourcing converts these into predictable monthly fees. This approach helps businesses avoid unexpected compliance penalties and reduces the need for additional payroll staff as the company grows.6.

6. How Does Payroll Outsourcing Reduce Payroll Errors?

Payroll vendors rely on automated systems and trained specialists to process salaries. This reduces manual calculations, which are a common source of mistakes. Built-in checks and standard workflows help identify issues before payments are released. As a result, payroll outsourcing often leads to fewer salary disputes, corrections, and compliance-related penalties.

7. Does In-house Payroll Offer Better Control?

In-house payroll provides direct access to data and allows quick internal changes. Companies can respond immediately to pay structure updates or employee queries. However, this control depends on skilled staff and updated systems. Without strong internal processes, in-house payroll can increase the risk of errors, delays, and compliance issues.

8. How Does Payroll Outsourcing Help With Business Growth?

Payroll outsourcing supports growth by handling higher employee volumes without adding internal workload. Businesses can expand into new locations without building new payroll processes from scratch. The payroll partner manages statutory rules and reporting, allowing leadership teams to focus on hiring, operations, and expansion rather than administrative payroll tasks.

9. When Should A Business Keep Payroll In-house?

Keeping payroll in-house works best for organizations with simple salary structures, stable teams, and experienced payroll staff. If compliance requirements are limited and headcount changes are rare, internal payroll may remain manageable. However, regular system updates and staff training are still necessary to avoid errors and filing delays.

10. How Much Time Does Payroll Outsourcing Save HR Teams?

Payroll outsourcing can save HR teams several hours each week. Tasks such as salary calculations, tax filings, and report preparation are handled externally. This reduces repetitive administrative work and allows HR staff to spend more time on employee relations, hiring coordination, and internal planning instead of routine payroll processing.

11. Is Payroll Data Safe With An Outsourced Provider?

Payroll data security depends on the provider’s systems and controls. Established payroll vendors like Skilldeck use secure servers, encryption, access controls, and regular audits. While data is shared externally, these safeguards are often stronger than what small or mid-sized businesses can maintain internally, reducing exposure to data leaks and unauthorized access.

12. Can Payroll Outsourcing Handle Multiple Locations or States?

Yes, payroll outsourcing is well-suited for multi-location operations. Vendors manage location-specific tax rules, statutory deductions, and reporting requirements. This removes the need for internal teams to track different regulations. Businesses benefit from consistent payroll processing even when employees are spread across cities, states, or regions.

13. What Happens If Payroll Errors Occur With An Outsourced Provider?

When errors occur, payroll providers follow defined correction procedures. Service agreements outline response timelines and accountability. While employers remain legally responsible, vendors help correct mistakes quickly and adjust future payroll runs. Regular reviews and clear communication reduce repeat issues and maintain payroll accuracy.

14. Can Businesses Switch From In-house To Outsourced Payroll Easily?

Switching to outsourced payroll requires planning but is manageable. The process includes data transfer, system setup, testing, and a parallel payroll run. Most transitions are completed within a few weeks. Clear documentation and cooperation between internal teams and the payroll provider help ensure a smooth changeover.