Payroll roles are becoming increasingly important as companies in India strive to maintain compliance and ensure accurate salaries. Employers seek individuals who understand basic statutory rules, can confidently handle calculations, and communicate effectively with employees. Because of this, payroll interviews usually include technical questions, behavioral questions, and real‑world scenarios.

This guide brings together top payroll process interview questions, sample answers, Indian statutory references, and common mistakes to help you prepare for your interviews.

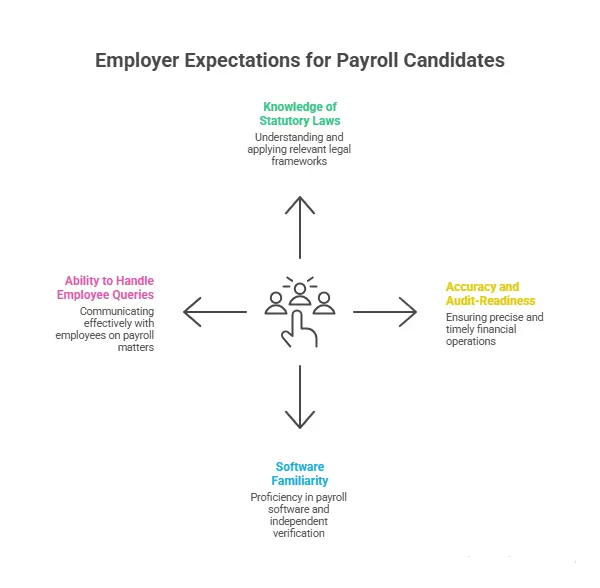

What Employers Look for in a Payroll Candidate (India)

Hiring managers want a balance of compliance knowledge, accuracy, and communication skills.

1. Knowledge of Statutory Laws

Payroll roles require working knowledge of:

- Employees’ Provident Fund (EPF) under the EPF Act (India’s EPFO outlines the PF contribution structure).

- Employees’ State Insurance (ESI) for employees earning up to ₹21,000 (as per ESIC rules).

- Professional Tax (PT) which varies by state.

- Income Tax deductions under the Income Tax Act.

- Payment of Wages, Minimum Wages, Bonus, and Gratuity Acts, which define employer responsibilities.

2. Accuracy and Audit-Readiness

Employers expect:

- Clean documentation

- Zero-error calculations

- On-time filings

- Precision in handling reconciliations and validations

3. Software Familiarity

Most Indian companies use tools like greytHR, Zoho Payroll, Keka, or Excel-based workflows. While software does calculations, companies want candidates who can verify results independently.

4. Ability to Handle Employee Queries

Payroll often involves explaining salaries, tax issues, PF deductions, or arrears, which demands clear and calm communication.

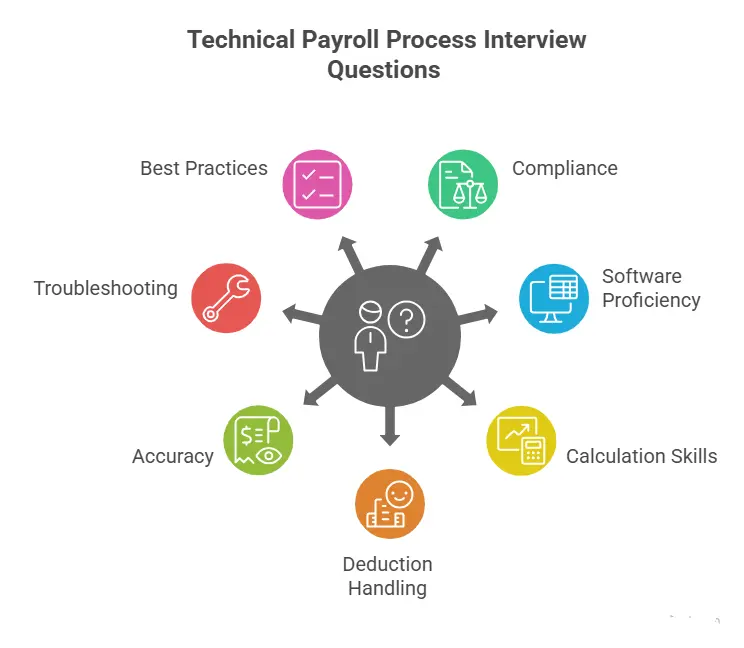

Technical Payroll Process Interview Questions (With Sample Answers)

Below are high-frequency questions tested in Indian payroll interviews.

1. Explain the end-to-end payroll process.

Sample Answer: Payroll starts with employee data collection, attendance, and LOP inputs. Then, gross salary is calculated, followed by statutory deductions such as PF, ESI, and TDS as defined by the Income Tax Act. After verifying outputs and approval, salary is processed, bank files are generated, and statutory returns are filed using portals such as EPFO, ESIC, and TRACES.

2. What is the difference between CTC, gross salary, and net salary?

Sample Answer: CTC includes employer costs like PF, gratuity, bonuses, and benefits. Gross salary includes earnings before statutory deductions. Net salary is what the employee receives after PF, ESI, PT, and TDS deductions.

3. How do you calculate TDS?

Sample Answer: TDS is calculated based on annual taxable income as per slabs published by the Income Tax Department of India. Exemptions such as HRA and LTA fall under Section 10, while deductions like 80C or 80D reduce taxable income. Monthly TDS is then divided across the remaining months of the financial year4. .

4. What is the PF wage ceiling?

Sample Answer: The Employees’ Provident Fund Organisation (EPFO) sets the statutory wage ceiling for PF at ₹15,000 per month. This means employees earning a basic salary + dearness allowance up to ₹15,000 must be enrolled for PF. For employees earning above ₹15,000, PF becomes voluntary unless they were already PF members before crossing this limit. Many companies still contribute higher wages based on internal policy, but this requires employer consent and is treated as a voluntary higher contribution.

3. How do you calculate TDS?

Sample Answer: The Employees’ Provident Fund Organisation (EPFO) sets the statutory wage ceiling for PF at ₹15,000 per month. This means employees earning a basic salary + dearness allowance up to ₹15,000 must be enrolled for PF. For employees earning above ₹15,000, PF becomes voluntary unless they were already PF members before crossing this limit. Many companies still contribute higher wages based on internal policy, but this requires employer consent and is treated as a voluntary higher contribution.

5. What is the ESI eligibility threshold?

Sample Answer: Under ESIC guidelines, employees earning up to ₹21,000 per month are mandatorily covered under ESI. This includes both basic pay and allowances. Once an employee is enrolled, contributions continue until the end of the contribution period, even if earnings cross the limit, ensuring continuous medical and insurance benefits.

6. How do you calculate LOP (Loss of Pay)?

Sample Answer: LOP is calculated by dividing the monthly gross salary by the total working days in the month and multiplying it by the number of unpaid days. This ensures deductions are proportionate to actual days of absence and keeps payroll aligned with statutory wage‑payment accuracy.

7. How do you process arrears?

Sample Answer: Arrears are processed when salary revisions apply to past months. I recalculate earnings for those months, adjust statutory deductions like PF, ESI, and TDS based on revised values, and ensure the difference is reflected in the current payroll. I also validate that arrears are documented for audits and compliance accuracy.

8. Which statutory forms are used in payroll?

- Form 16 for annual TDS certificate (through TRACES).

- Form 24Q for quarterly TDS returns.

- PF ECR for monthly PF filing.

- ESI contributions return through the ESIC portal.

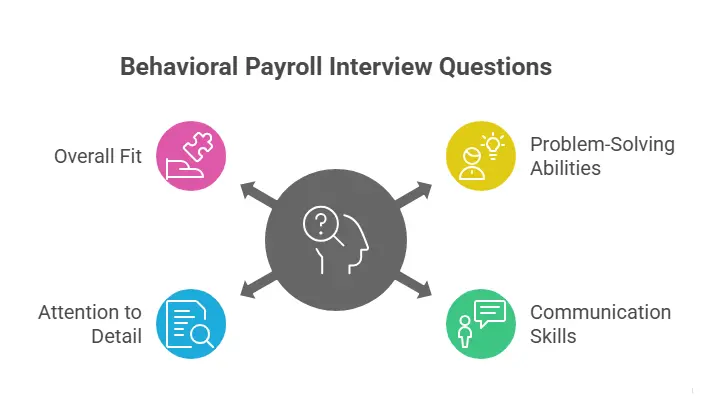

Behavioral Payroll Process Interview Questions (With Sample Answers)

These questions help employers understand your attitude, communication, and problem‑solving style.

1. How Do You Handle Payroll Errors?

Sample Answer: I review the source of the error, correct the data in the payroll master, communicate the fix to the employee, and check whether statutory filings need adjustments. I document the correction to avoid repeat issues.

2. How Do You Manage Employee Grievances About Salary?

Sample Answer: I start by understanding the concern, then verify the salary breakup, deductions, or attendance records. I explain the calculation clearly and share supporting documents if needed.

3. Describe How You Work Under Payroll Deadlines.

Sample Answer: I plan tasks based on priority. Payroll deadlines are fixed, so I prepare inputs early, run validations, and communicate proactively with HR and finance to avoid last‑minute issues.

4. How Do You Communicate Complex Payroll Information To Non‑HR employees?

Sample Answer: I simplify the explanation, avoid technical terms, and break down salary components using examples. I show sample calculations or payslip highlights for clarity.

5. Tell Us About A Time You Resolved a Payroll Dispute.

Sample Answer: I had a case where an employee’s PF deduction seemed higher than expected. I reviewed the salary revision and explained how the PF ceiling applied. After showing the calculation, the employee was satisfied. I updated the help document so others could understand PF logic easily.

6. How Do You Ensure Confidentiality In Payroll?

Sample Answer: I restrict access to payroll files, follow company data‑protection rules, and avoid discussing salary details outside authorized conversations. I use password‑protected sheets and portal-based access whenever possible.

7. How Do You Deal With Conflicting Priorities During Payroll Week?

Sample Answer: I classify tasks based on urgency and compliance impact. Payroll processing, statutory filings, and approvals come first. I communicate realistic timelines to stakeholders and ensure each step is completed accurately before moving forward.

Scenario-Based Payroll Questions (India)

These test how well you apply payroll rules.

Scenario 1: An employee joins mid-month. How will you calculate salary?

Answer: Salary is prorated based on actual working days. Exemptions and statutory deductions apply proportionately.

Scenario 2: An employee switches between old and new tax regimes mid-year. What changes?

Answer: The Income Tax Department allows regime switching during return filing. Payroll must adjust TDS from the month of declaration.

Scenario 3: How Do You Handle Negative Arrears?

Negative arrears arise during corrections. The difference is recovered from the salary or adjusted in the next payroll cycle.

Scenario 4: If Wages Exceed ₹15,000 Per Month, How Do You Handle PF?

Answer: PF contribution above ₹15,000 becomes voluntary unless the employee was already a PF member. The EPFO allows contributions above the ceiling with employer consent.

Common Mistakes Candidates Make in Payroll Interviews

Avoiding these mistakes improves your chances.

- Not knowing PF or ESI thresholds.

- Confusing exemptions with deductions.

- Giving unclear answers about CTC structure.

- Forgetting compliance timelines (PF, ESI, TDS, PT).

- Relying too much on payroll software without manual validation.

- Mixing payroll tasks with HR operations.

Sample Answers to High-Frequency Payroll Interview Questions

Below are structured answers you can reuse during interviews.

1. Explain Payroll Process Step-By-Step.

Payroll begins with gathering attendance and employee data. Gross salary is calculated, followed by statutory deductions such as PF (EPFO rules), ESI (ESIC rules), PT, and TDS as per income tax slabs. After validation and approvals, salary is disbursed, and statutory filings are submitted before due dates.

2. How Do You Calculate Overtime (OT)?

OT is usually calculated as OT Pay = 2 × (Monthly Pay / Total Monthly Hours) × OT Hours, but it can vary by state and situation (weekly offs/holidays often use higher multipliers like 2x or 3x).

3. What Happens If PF Contribution Is Deducted Incorrectly?

Corrections are made in the PF ECR. The EPFO allows adjustments in the next filing cycle.

4. How Do You Calculate Taxable Income?

Taxable income = gross income – exemptions under Section 10 – deductions under Chapter VI-A.

5. How Do You Handle Full-and-final Settlements?

FnF includes pending salary, LOP adjustments, leave encashment, reimbursements, and statutory deductions. Gratuity applies as per the Gratuity Act for 5+ years of service.

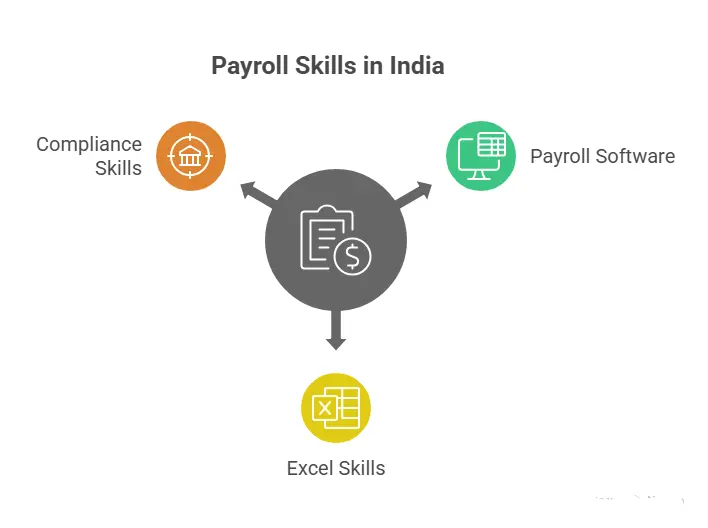

Payroll Skills Employers Expect in India

Payroll Software Knowledge

Companies look for hands-on experience with payroll tools and Excel.

1. Key Excel Skills

- Pivot tables

- VLOOKUP/XLOOKUP

- Data validation

- Formula auditing

2. Compliance Skills

Knowledge of portals like:

- EPFO for PF returns

- ESIC portal for ESI contributions

- TRACES for TDS reconciliation

Final Tips to Crack Payroll Interviews In India

- Learn statutory rules and thresholds from official government sites.

- Practice payroll calculations manually.

- Prepare scenario-based answers.

- Keep explanations clear and structured.

- Review monthly compliance due dates.

FAQs On Payroll Process Interview Questions

1. What Are The Basic Statutory Components Of Indian Payroll?

Indian payroll includes PF (EPF Act), ESI (ESIC rules), TDS (Income Tax Act), and Professional Tax, depending on the state. Official information is available on the EPFO, ESIC, and Income Tax Department websites.

2. What Is The PF Wage Ceiling In India?

The EPFO sets the mandatory PF wage ceiling at ₹15,000 per month, as per official EPFO guidelines.

3. Which Tax Regime Do Companies Follow For Payroll?

Companies process payroll under the tax regime chosen by the employee. The Income Tax Department outlines the old and new tax regime slabs.

4. How Often Are Payroll Compliance Filings Done?

PF and ESI are filed monthly through EPFO and ESIC portals. TDS returns (Form 24Q) are filed quarterly via TRACES.

5. Which Skills Help Freshers Crack Payroll Interviews?

Knowledge of statutory basics, strong Excel skills, and clear understanding of payroll workflow help candidates. Government portals like EPFO and ESIC provide reliable statutory information. Candidates can also enroll in a reputed Indian Payroll Course and learn from experts.

6. What Documents Are Required To Run Monthly Payroll?

Payroll teams typically use attendance data, leave records, new-joiner details, resignations, investment declarations, proofs, and updated salary structures. These inputs ensure accurate calculations and compliance-ready results.

7. How Is Income Tax Calculated For Employees In India?

Income tax is calculated based on the employee’s chosen regime, taxable income, HRA exemptions, and deductions such as 80C or 80D. Monthly TDS is then distributed across the remaining months of the financial year.

8. What Happens If An Employee Does Not Submit Investment Proofs?

If proofs are not submitted by the deadline, payroll recalculates taxable income and deducts higher TDS. Employees can claim refunds later through income tax returns.

9. How Does Payroll Handle Mid-year Salary Revisions?

Salary revisions trigger arrears or adjustments for past months. Payroll recalculates earnings, updates statutory deductions, and reflects differences in the next salary cycle.

10. What Should Candidates Prepare Before Attending A Payroll Interview?

Candidates should review statutory basics, practice salary breakup calculations, prepare examples of past payroll tasks, and revise Excel skills like VLOOKUP and pivot tables.